In 2022, to further enhance corporate governance, Azbil Corporation transitioned from being a company with an audit & supervisory board to a company with a three-committee board structure; this followed the approval of the Ordinary General Meeting of Shareholders held in June of that year. Simultaneously, a change was made to the composition of the company’s Board of Directors, ensuring that more than half of its members (8 of 12) would be independent outside directors.

At this time, I was appointed as an outside director (up until then I had served as an outside Audit & Supervisory Board Member for three years), and also Chairperson of the Audit Committee. Working with the two other Audit Committee members, I determined how the new committee would operate. We have also promoted systematic auditing that strengthens cooperation with the Internal Audit Department and the Audit & Supervisory Board Members of Group companies in Japan and overseas. Furthermore, we have increased opportunities to exchange opinions with Group executives (corporate executives, CEOs of Group companies, etc.) and, with the effective end of the COVID-19 pandemic, we have resumed on-site audit inspections of overseas subsidiaries.

The Nomination Committee and the Remuneration Committee have also met frequently, ensuring that new arrangements become firmly established. There have been trenchant discussions on such topics as HR development to foster leadership and the new board structure, as well as reviewing the remuneration system. All three committees report to the Board of Directors, as and when appropriate, on the progress and conclusions of their deliberations.

The Board Rules stipulate that the Board of Directors delegates significant authority for business execution to the management team. This has increased the amount of time available for discussing corporate strategy, including the medium-term plan, risk management, and sustainability. Board meeting agenda items are previewed, and liaison meetings for directors and corporate executives are held almost every month to discuss how management issues are being addressed and how business plans are progressing. Moreover, from this year, monthly meetings have been held exclusively for outside directors to share information and raise points for discussion; the resulting free exchange of opinions is informed by the experience and expertise of the individual directors.

As we go forward, making steady progress with corporate governance under the new board structure, prompt and precise decision-making will be cultivated, while the objective oversight function of the Board of Directors will be strengthened. Furthermore, by fostering an environment that supports apposite risk-taking, we intend to contribute to accelerating business growth.

Corporate Governance

Basic Approach

In order to deserve the trust of our shareholders and other stakeholders, the Company’s fundamental approach to corporate governance is not just to ensure compliance with laws and regulations and our Articles of Incorporation, but also to fulfill our social responsibilities based on corporate ethics and to contribute to society while continuously improving enterprise value through efficient and transparent management. We see this as a top management priority.

The azbil Group has established its long-term targets (to achieve by FY2030) and a medium-term plan (FY2021-FY2024), whose aim is to contribute “in-line” to a sustainable society and achieve growth through providing automation-related products and services. Guided by the Group philosophy of “human-centered automation”, we will secure our own medium- and long-term development while implementing sustainable enhancement of enterprise value. At the same time, we recognize that it is corporate governance which provides the foundation for such sustainable enhancement of enterprise value, and so improving corporate governance is a key issue for management. We are therefore working to strengthen the supervisory and auditing functions of the Board of Directors, enhance the transparency and soundness of management, and clarify responsibilities for business execution. To facilitate this, we have recently transitioned from being a company with an audit & supervisory board to a company with a three-committee board structure, following the approval of a proposal to amend our Articles of Incorporation at the 100th Ordinary General Meeting of Shareholders held on June 23, 2022.

Azbil Corporation's report on corporate governance (full text) is available here.

Corporate Governance Report revised on 11 January, 2024(PDF/857KB)

- Basic Policy for Corporate Governance

- Corporate Governance Framework

- Changes to Improve Corporate Governance

- Overall Balance and Diversity of the Board of Directors

- Improving the Effectiveness of the Board of Directors

- Executive Compensation

- Contribution of Outside Directors

- Comment by an Outside Director

Basic Policy for Corporate Governance

(1) Ensuring the rights and equality of shareholders

In order to ensure that shareholders’ rights are substantially secured, the Company takes appropriate measures in accordance with laws and regulations, and, giving due consideration to all shareholders including foreign shareholders and minority shareholders, is promoting the development of an environment in which shareholders can exercise their rights equally and appropriately.

(2) Appropriate cooperation with stakeholders who are not shareholders

In order to achieve sustainable growth and increase enterprise value over the medium to long term, we believe that the Company must be strongly aware of its corporate social responsibility and conduct management that is appropriate for all our stakeholders. For this purpose, we have adopted “human-centered automation” as our Group philosophy to realize safety, comfort and fulfillment in people’s lives and contribute to the global environment. To this end, we have instituted Guiding Principles for azbil Group Business and established the azbil Group Code of Conduct to provide specific guidelines for all officers and employees of the Company and the azbil Group. In FY2022, we updated a number of basic policies that comprise important concepts underpinning the Company’s fundamental stance; this is essential for implementing the Group’s philosophy, Guiding Principles, and Code of Conduct. Also, we have set the essential goals of the azbil Group for the SDGs (basic goals and targets) toward achieving the UN’s SDGs. With these SDGs as our new guidepost, we aim to connect our philosophy, Guiding Principles, Code of Conduct, and management strategy, leading “in series” to a sustainable society, and to realize a balance between resolving social issues and sustainable growth. As regards achieving diversity in human resources, we are actively working to promote the advancement of female employees based on the recognition that having diverse values within a company is essential when it comes to achieving sustainable growth.

With regard to the internal reporting system, we believe it is important to (a) encourage employees to use this system by dispelling any concerns that in so doing they might be put at a disadvantage, and (b) ensure that the information thus conveyed is used appropriately. We have therefore established a user-friendly reporting & consultation system—the CSR Hotline—which ensures that the information received is reported to the president & CEO, Audit Committee Members, and outside directors.

(3) Ensuring appropriate information disclosure and transparency

The Company strives to disseminate information so as to ensure transparency and fairness in decision-making, thus realizing effective corporate governance. Specifically, in order to ensure that all stakeholders have a proper understanding of financial information—such as the Company’s financial position and business results—as well as non-financial information—such as management strategy, management planning, management issues, and information relating to risk and governance—we actively disclose information on a voluntary basis in addition to the information stipulated by law. The Company also discloses policies and procedures regarding the appointment of directors and corporate executives (shikkoyaku), as well as the selection and dismissal of senior executives including the CEO, and policies for deciding on the remuneration for directors and corporate executives. We will continue to strive to increase the scope of information covered by these disclosures and ensure transparency.

In addition, we are taking appropriate measures to ensure proper audits by the independent accounting auditor: the Company provides sufficient time for audits to be conducted, arranges for the accounting auditor to interview the president & CEO and t

he officer in charge of finance on a regular basis, and continuously conducts quarterly report meetings between the accounting auditor, the Audit Committee, and the Internal Audit Department.

(4) Responsibilities of the Board of Directors, etc.

The basic mission of the Board of Directors is to put in place an appropriate corporate governance system and to implement this so as to achieve sustainable growth for the Company and enhance its enterprise value.

The Board Rules stipulate that basic management strategy and management plans are important items for deliberation, and following discussions that are unrestricted, robust and constructive, the Board will make appropriate decisions. Moreover, to ensure transparency and fairness in management, the Company will ensure timely disclosure and systems for internal control and risk management. At the same time, the Audit Committee, in cooperation with the Internal Audit Department, will successively provide appropriate audits and opinions on management.

The Company recognizes that independent outside directors play a key role in ensuring that the Board properly fulfills its functions and responsibilities, and thus it has appointed eight independent outside directors with a broad range of experience in corporate management and supervision, as well as considerable expertise and knowledge. Drawing on their diverse backgrounds, these independent outside directors adopt a wide range of perspectives to fulfill their responsibilities, offering advice on improving enterprise value, supervising management, etc. For the Board of Directors to effectively fulfill its roles, the Company believes that, in appointing directors, it is important to promote diversity, taking into consideration the balance of knowledge and experience, and also to ensure transparency and objectivity in the selection process.

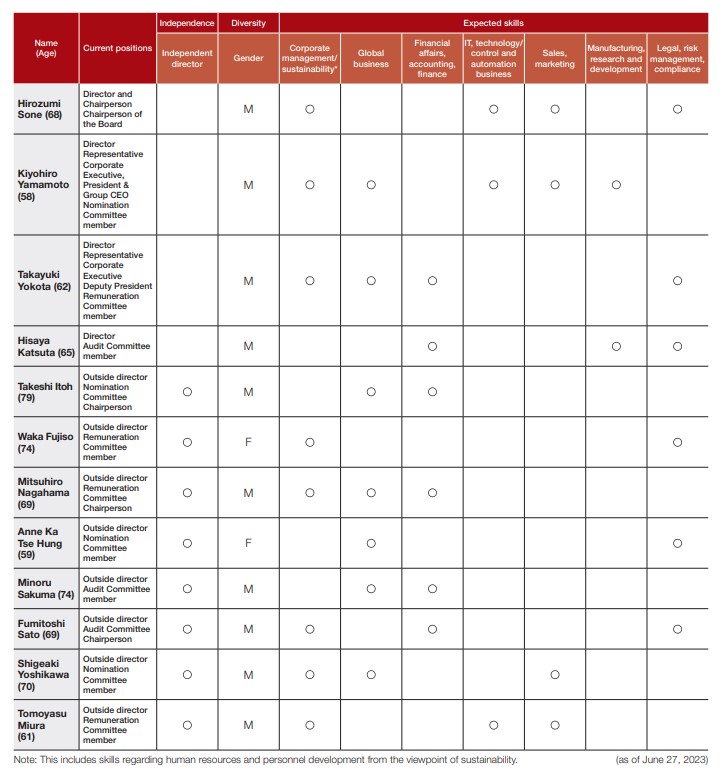

Giving due consideration to such management strategies as the realization of the medium-term plan, the Company has set out what skill sets are expected of its directors and has confirmed the requisite independence, diversity, and anticipated skills (skills matrix) of its current Board.

Regarding succession planning for the Company’s senior management, the Nomination Committee discusses the ongoing training and selection of successors; record the results of those discussions as well as the process of deliberation; and regularly report to the Board of Directors on details of their deliberations. The Company thus ensures that succession planning is implemented in an appropriate and objective manner, that the Board is proactively involved in succession planning, and that the training of potential successors is conducted systematically, with sufficient time and resources. As of June 27, 2023, the total number of directors is 12, with outside directors representing a majority. Board composition demonstrates ample diversity, including that of nationality and gender.

(5) Dialogue with shareholders

In order to meet requirements for corporate accountability while contributing to sustainable growth and the enhancement of enterprise value over the medium to long term, the Company is working to develop and implement a system for promoting constructive dialogue with shareholders and investors.

Regarding the publication of management strategies and plans, as well as presenting basic policies such as earnings plans, the Company strives to provide straightforward explanations of the targets of financial affairs (sales, operating income, ROE, etc.) and non-financial affairs in our medium-term plan, as well as outlining strategies for achieving those targets.

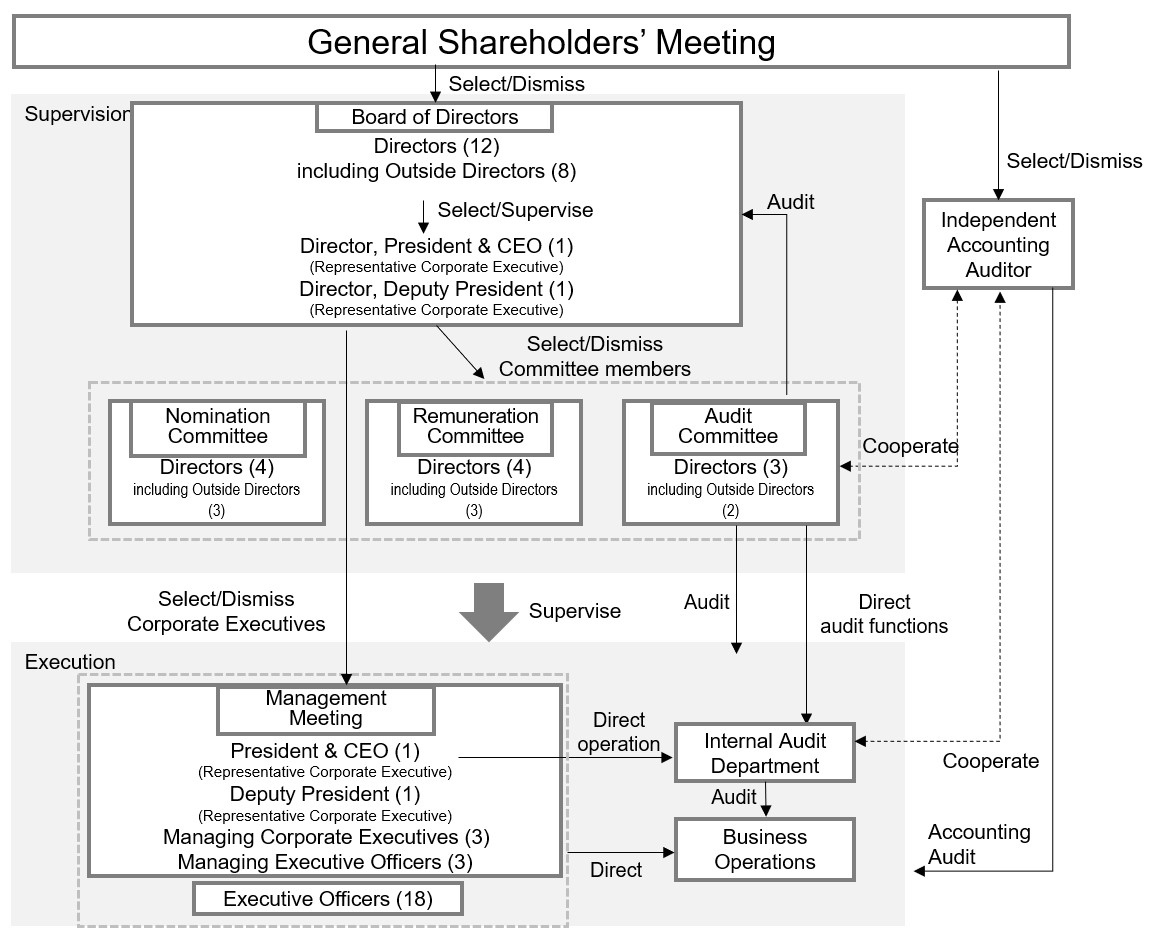

(6) Overview of corporate governance system and reasons for adopting the system

To ensure its own medium- to long-term development, respond to the trust of all its stakeholders including its shareholders, and proceed with consistently increasing enterprise value, the azbil Group sets fortifying the underlying corporate governance as a management priority. Measures have included strengthening the supervisory and auditing functions of the Board of Directors, improving management transparency and soundness, and clarifying the structure of responsibility for the execution of duties.

The Company has transitioned from having an Audit & Supervisory Board to having a three-committee board structure, following the approval of a proposal to amend its Articles of Incorporation at the 100th Ordinary General Meeting of Shareholders held on June 23, 2022. Accompanying this transition to a three-committee board structure, three statutory committees – the Nomination Committee, Audit Committee, and Remuneration Committee – have been established, each consisting of a majority of Independent Outside Directors and being chaired by an Independent Outside Director. In addition, by substantially transferring business execution authority from the Board of Directors to Corporate Executives with clear legal responsibilities, we are clearly separating supervisory and execution functions to ensure a business execution system based on flexible and efficient decision making, while at the same time enhancing the objective supervision of management.

Furthermore, as a company with a three-committee board structure, to ensure the effectiveness of monitoring by the Board of Directors, we have established a forum for providing information to directors and exchanging opinions with corporate executives in the form of a Liaison Meeting for Directors and Corporate Executives. In addition, opinion exchange meetings are held regularly among outside directors. At the same time, we are continuing the system for Executive Officers charged with business execution, aiming to enhance the quality and speed of decision-making.

The Board of Directors is convened monthly in principle, to discuss and consider legal issues, and other important managerial matters as the highest decision-making body for management and provide a major direction, and to exercise appropriate supervision over execution in order to reflect opinions of stakeholders. In business execution, the management meetings, which Corporate Executives and Executive Officers with titles attend, have been established to serve as an executive-level advisory body to assist President & Group CEO in making decisions, and are attended by the full-time Audit Committee Member to ensure the effectiveness of monitoring. The management meetings are held twice a month as part of ongoing initiatives to strengthen business operations through prompt decision making and strict execution.

As of June 27, 2023, the Company has appointed a total of 12 Directors, including four (4) who are involved in business execution and have accumulated experience in the Company’s business, management and audits (Hirozumi Sone, Kiyohiro Yamamoto, Takayuki Yokota, and Hisaya Katsuta), as well as eight (8) who are Independent outside directors and have independence, broad experience, a wealth of expertise and knowledge, and rich diversity in the form of nationality and gender (Takeshi Itoh, Waka Fujiso, Mitsuhiro Nagahama, Anne Ka Tse Hung, Minoru Sakuma, Fumitoshi Sato, Shigeaki Yoshikawa, and Tomoyasu Miura). Independent outside directors have made up the majority of the Board of Directors. In addition to working diligently to contribute to the enhancement of the Company’s enterprise value through appropriate oversight and advice during the decision-making process at Board of Directors meetings, these independent outside directors regularly exchange opinions with corporate executives.

Also, a survey was again carried out this year, like last year, to evaluate the effectiveness of the Board of Directors, to identify issues and possible improvements, and to provide suggestions as to how the Board’s effectiveness might be enhanced. We were able to confirm that, following the transition to a company with a three-committee board structure, steady progress has been made in both strengthening governance and improving the effectiveness of the Board of Directors. In preparing for this evaluation, the Chairperson led a review with outside directors of the approach and methodology to be used, and—so as to ensure objectivity and facilitate more effective initiatives in the future—an outside organization was tasked with compiling both the survey items and the results.

(7) Status of Activities of the Board of Directors and each committee

<Status of Activities of the Board of Directors>

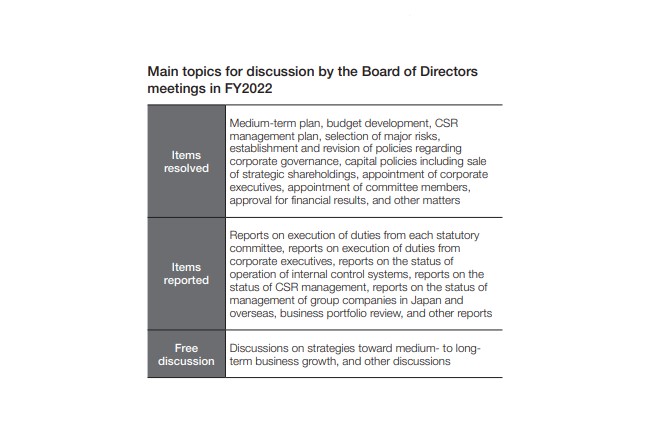

In fiscal year 2022, the Board of Directors met a total of 12 times. The 12 Directors attended all of the meetings. Because Directors Shigeaki Yoshikawa and Tomoyasu Miura were elected at the 100th Ordinary General Meeting of Shareholders held on June 23, 2022, their attendance only applies to the Board of Directors meetings held after their appointment. Major items discussed at the Board of Directors meetings are as follows.

<Status of Activities of the Nomination Committee, the Audit Committee, and the Remuneration Committee>

(Nomination Committee)

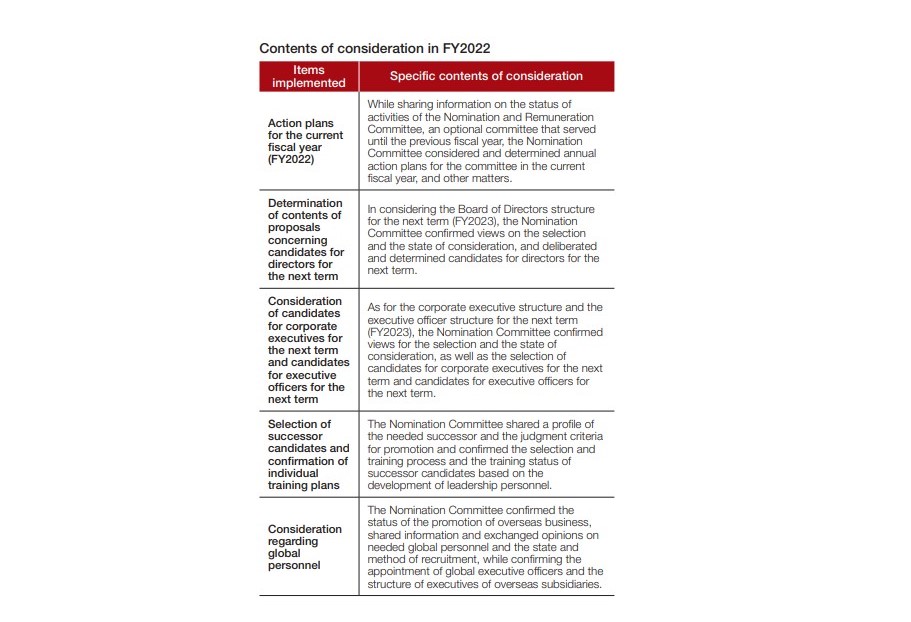

As of June 27, 2023, for the Nomination Committee, Takeshi Itoh (Independent Outside Director) serves as the Committee chairperson, Anne Ka Tse Hung (Independent Outside Director), Shigeaki Yoshikawa (Independent Outside Director), and Kiyohiro Yamamoto (Director, President and Group CEO) serve as committee members, with Independent Outside Directors comprising a majority of the Committee. In fiscal year 2022, the Nomination Committee met nine (9) times, and three (3) members of the Nomination Committee (Takeshi Itoh, Anne Ka Tse Hung, and Shigeaki Yoshikawa) attended all of the meetings, and one (1) member (Kiyohiro Yamamoto) participated in eight (8) of them. Specific items considered by the Nomination Committee are as follows.

(Audit Committee)

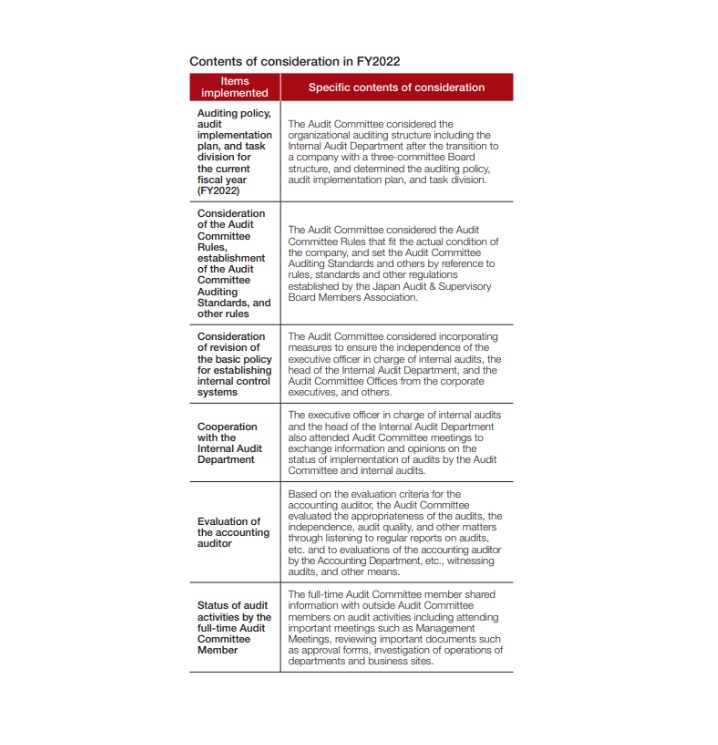

As of June 27, 2023, for the Audit Committee, Fumitoshi Sato (Independent Outside Director) serves as the Committee chairperson, Minoru Sakuma (Independent Outside Director) and Hisaya Katsuta (Non-executive inside Director) serve as committee members, with Independent Outside Directors comprising a majority of the Committee. Two (2) Independent Outside Directors and one (1) Non-executive inside Director who is versed in the Company’s businesses formulate audit plans together with the Internal Audit Department and conduct multifaceted auditing activities, and the internal Audit Committee Member serves on a full-time basis, to enhance the effectiveness of audits by the Audit Committee. The Audit Committee chairperson Fumitoshi Sato has experience as the person responsible for the creation of financial statements as the officer in charge of accounting and finance at another operating company over many years and thus has a wealth of knowledge concerning financial affairs and accounting. Furthermore, the Company established an Audit Committee Office, an organization dedicated to assisting the Audit Committee in its duties, with three (3) staff members assigned to assist the Audit Committee in the execution of its duties. The Audit Committee convenes in principle once a month and holds ad-hoc meetings, as necessary. In fiscal year 2022, it convened a total of 11 times and the three (3) Audit Committee Members participated in all of the meetings. Specific items considered by the Audit Committee are as follows.

The Audit Committee Members determined the task division, and performed attendance at the Board of Directors meetings and a Liaison Meeting for Directors and Corporate Executives, exchange of opinions with Corporate Executives, Executive Officers and President of subsidiaries, investigation of business operations of departments, business sites and subsidiaries, sharing of the audit plan and audit results with the Internal Audit Department, participation in certain operation audits performed by the Internal Audit Department as an observer, communication and exchange of information with Audit & Supervisory Board Members of subsidiaries in Japan, listing to explanations on the status of implementation of audits and audit results, consideration of items, contents, etc. of key audit matters (KAM), and other matters from the Accounting Auditor.

Furthermore, all Audit Committee Members including outside Audit Committee Members were appointed as select Audit Committee Members, and outside Audit Committee Members also conducted many audit operations including meetings to exchange opinions with Corporate Executives and Executive Officers. Moreover, Audit Committee Members discussed internal issues, other companies’ instances of fraud, and other matters.

Continuing from last fiscal year, though audit activities were affected by COVID-19 to some degree, the Audit Committee used a mix of visiting audits and remote surveys using an online conferencing system. Furthermore, on-site visiting audits were also resumed for overseas subsidiaries.

(Remuneration Committee)

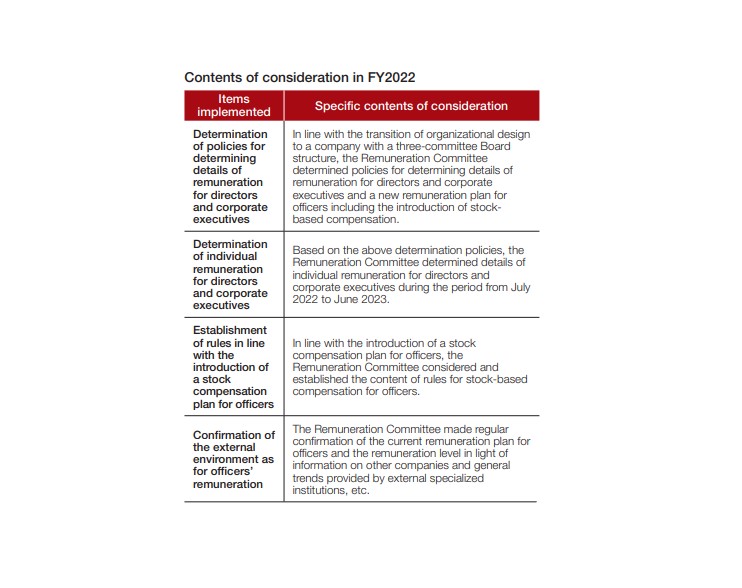

As of June 27, 2023, for the Remuneration Committee, Mitsuhiro Nagahama (Independent Outside Director) serves as the Committee chairperson, Waka Fujiso (Independent Outside Director), Tomoyasu Miura (Independent Outside Director), and Takayuki Yokota (Director, Representative Corporate Executive Deputy President) serve as committee members, with Independent Outside Directors comprising a majority of the Committee. In fiscal year 2022, the Remuneration Committee met seven (7) times and all the four (4) Remuneration Committee Members attended all of the meetings. Specific items considered by the Remuneration Committee are as follows.

(8) Appointment of candidates for Directors, and the election/dismissal of senior management including CEO

a. Appointment of directors

In terms of basic qualifications, a candidate director is to be a person with excellent character and insight who contributes to the growth of the Company and the Group and helps to enhance enterprise value. The Company has a policy of appointing directors who are involved in business execution to be persons that have a high level of ability and knowledge about each business segment and important management functions, while outside directors must have wide-ranging experience, excellent expertise and knowledge, and must also have the ability to proactively express their opinions and raise issues from outside perspectives and diverse backgrounds. In addition, the Company takes into the diversity such as gender and internationality consideration in the selection process. The Nomination Committee decides on the nomination and election of candidates for Board of Directors.

b. Appointment/dismissal of the CEO and subordinate officers

The appointment of the CEO and other senior executives (president & CEO, deputy president, and the like) is decided by the Board of Directors after deliberation by the Nomination Committee, based on appointment criteria standards and the desired composition of the Board of Directors.

(Appointment criteria)

To be nominated, candidates must have a full understanding of the Group philosophy, deep knowledge of corporate management, and wide-ranging experience both inside and outside Japan, as well as good insight on corporate governance, CSR, and compliance. They must meet the following criteria and be capable of leading the Group to sustainable growth.

1. Good character and insight, and selfless attitude; a person who earns the trust of others;

2. The ability to think and judge from an international perspective and from the standpoint of the entire Group;

3. Exceptional insights, the ability to implement change and innovation and anticipate the future, and the willingness to embrace the challenges of a results-oriented approach; and

4. Healthy, energetic, physically sound, and mentally resilient.

(Dismissal criteria)

Concerning policies and procedures for dismissing the CEO and other senior executives (president & CEO, deputy president, and the like), the candidate for dismissal undergoes a fair and rigorous process of examination and deliberation by the Nomination Committee based on the following criteria. If the committee judges that the dismissal is appropriate, it is sent to the Board of Directors for approval.

Reasons for proposing dismissal include serious business problems arising from a violation of the law or the Articles of Incorporation, an event that makes it difficult for the person to perform and continue in the job, and confirmation that the person does not meet the appointment criteria.

Corporate Governance Framework (As of June 27, 2023)

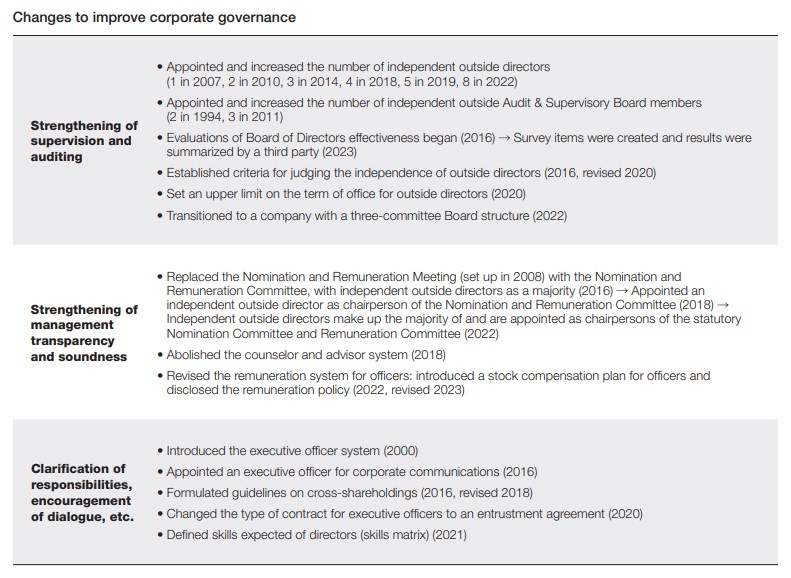

Changes to Improve Corporate Governance

We strive to strengthen and enhance corporate governance to ensure fairness, transparency and objectivity of the management.

Overall Balance and Diversity of the Board of Directors

In a rapidly changing business environment, we believe that the Company needs a Board of Directors that offers diversity and provides a good overall balance of knowledge and experience that will contribute to the enhancement of enterprise value over the medium to long term. Based on this fundamental principle, as of June 27, 2023, the Board of Directors consists of four (4) directors with executive experience in the Company’s business, audit and management and eight (8) independent outside directors with wide-ranging experience, extensive expertise and professional knowledge.

Of the twelve (12) directors, two (2) are women (one of whom is a foreign national). Also, we have established the skill sets expected of the directors with respect to the realization of the Company’s medium-term plan and other management strategies, and we have confirmed the independence, diversity, and expected skills of the current entire Board of Directors.

Improving the Effectiveness of the Board of Directors

In order to clearly separate supervisory and executive functions, and to lend impetus to a further strengthening of the management oversight function, Azbil Corporation transitioned from being a company with an audit & supervisory board to a company with a three-committee board structure, following approval at the Ordinary General Meeting of Shareholders held on June 23, 2022. Through conducting objective and constructive deliberations, the Company’s Board of Directors decides on such matters as management strategy, supervises their execution, and strives to enhance enterprise value over the medium to long term. A survey was again carried out this year, like last year, to evaluate the effectiveness of the Board of Directors in properly fulfilling its roles and responsibilities, to identify issues and possible improvements, and to provide suggestions as to how the Board’s effectiveness might be enhanced. We were thus able to confirm that, following the transition to a company with a three-committee board structure, steady progress has been made in both strengthening governance and improving the effectiveness of the Board of Directors. In preparing for this evaluation, the Chairperson led a review with outside directors of the approach and methodology to be used, and—so as to ensure objectivity and facilitate more effective initiatives in the future—an outside organization was tasked with compiling both the survey items and the results.

For this survey of FY2022, all directors were asked for their opinions and assessments of (1) the role and functions of the Board of Directors; (2) the size and composition of the Board of Directors; (3) the operation of the Board of Directors; (4) the composition, role, and work of the Nomination Committee; (5) the composition, role, and work of the Remuneration Committee; (6) the composition, role, and work of the Audit Committee; (7) the support provided for outside directors; (8) investor and shareholder relations; (9) the overall effectiveness of the governance system and the Board of Directors; and (10) their own self-evaluations. Based on the above, the Board of Directors held constructive discussions on current effectiveness as well as issue-sharing and future steps.

It has thus been concluded that the Board of Directors is of an appropriate size and composition, and is properly fulfilling its role, with its members plainly sharing the Board’s supervisory function for a company with a three-committee board structure; that—thanks to the Liaison Meeting for Directors and Corporate Executives, a forum established so that directors can gather information and exchange opinions with corporate executives—there is sufficient communication between directors and corporate executives, as well as between internal directors and outside directors, and that this is contributing to the smooth transition to the new board structure; that the size, composition, and deliberation topics of the three statutory committees for nomination, remuneration, and audit are all appropriate; and that the overall effectiveness of the Board of Directors is adequately ensured. In last year’s assessment of effectiveness, Board members all recognized the importance of sharing and discussing the progress of the medium-term plan. Consequently, in FY2022, in addition to being deliberate at Board meetings and at the above-mentioned Liaison Meeting for Directors and Corporate Executives, the medium-term plan was also the subject of intensive discussions at off-site meetings made possible following the lifting of restrictions related to the COVID-19 pandemic. These opportunities were used to review the plan and discuss business strategies to achieve long-term growth and long-term targets; topics included capital policy, overseas business strategy, development capabilities, DX and related businesses, and the business portfolio. These initiatives represented one of the items covered by this year’s survey of effectiveness.

Going forward, members agreed that the Board of Directors will strive to make a clearer division of supervisory and executive roles, and to improve the reference materials prepared for meetings so that the Board can discuss more important management issues, and also that the Board of Directors and Nomination Committee will discuss the skills matrix required to maintain the appropriate composition of the Board of Directors, improving it where possible. In order to achieve sustainable growth and increase enterprise value over the medium to long term, the Company will continue its efforts to enhance the effectiveness of the Board of Directors.

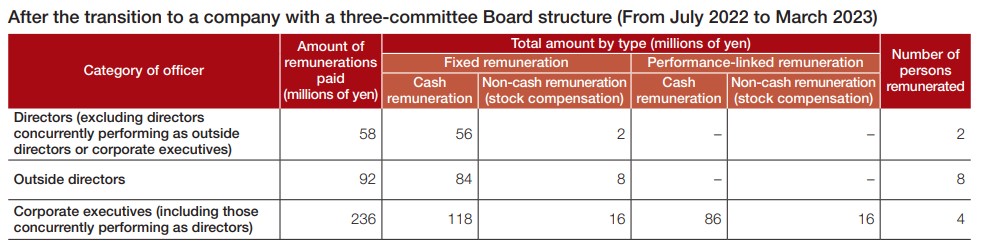

Executive Compensation

Along with the transition to a company with a three-committee board structure, the Remuneration Committee, which is chaired by an outside director, has formulated a policy for determining executive remuneration suited to the new corporate structure. In conjunction with this revision of the executive remuneration system, which now includes a stock compensation plan, the company has disclosed its new remuneration policy.

Remuneration Policy of Azbil Corporation

Guided by the azbil Group philosophy of “human-centered automation,” Azbil Corporation (“the Company”) aims to contribute “in series” to a sustainable society by providing automation-related products and services.

With regard to our executive remuneration system, in order to add impetus to the realization of our long-term targets (to achieve by FY2030) and the medium-term plan (FY2021-FY2024), we will further increase both the corporate executives’ awareness of the need to contribute to enhancing enterprise value and their motivation to maximize shareholder value, as well as ensuring that directors who are not responsible for business execution can share value with our shareholders. With this system, we will promote initiatives to contribute “in series” to a sustainable society.

The azbil Group philosophy

The azbil Group philosophy is to realize safety, comfort and fulfillment in people’s lives and contribute to global environmental preservation through “human-centered automation.” To achieve this,

- We create value together with customers at their site.

- We pursue our unique value based on the idea of “human-centered.”.

- We think towards the future and act progressively.

Basic policy regarding executive remuneration

Aiming to realize the Group philosophy, we have adopted the following basic policy for the remuneration of Company officers to motivate them not only for short-term performance but also to achieve medium- to long-term performance goals and to enhance enterprise value.

- Taking into consideration the nature of our business, remuneration should encourage awareness of the necessity to enhance enterprise value from a medium- to long-term perspective and further promote value sharing with our shareholders.

- Remuneration should help to secure talented management personnel to realize the Company’s management philosophy and achieve the medium- to long-term performance goals.

- The remuneration system should be highly independent and objective, and should enable us to fulfill our duty of accountability to stakeholders.

Remuneration levels

Remuneration levels for the Company officers (corporate executives and directors) are set by resolution of the Remuneration Committee after it has verified their appropriateness using data supplied by an external research agency. Also, the Committee reviews remuneration levels as necessary in response to changes in the external environment.

Remuneration structure

The remuneration structure for corporate executives (including those concurrently serving as directors, similarly hereafter) consists of basic remuneration, which is a fixed monthly amount based on their roles and responsibilities; bonuses which are short-term incentives; and stock-based compensation which is a medium- to long-term incentive. In order to ensure a remuneration structure that motivates officers to achieve our medium- to long-term performance goals and enhance enterprise value, the incentive component of remuneration has been increased, and the combined remuneration for corporate executives is expected to break down as follows: basic remuneration 50%, bonus (base amount) 30%, stock-based compensation (base amount) 20%. The remuneration for directors (not including those concurrently serving as corporate executives; similarly hereafter) consists of basic remuneration and stock-based compensation.

- Corporate executives

(1) Basic remuneration- Basic remuneration is paid as a fixed monthly monetary remuneration based on the position of the officer.

- A bonus is paid as performance-linked monetary remuneration that takes into consideration company performance and non-financial indicators for the single fiscal year.

- As regards financial indicators, to improve enterprise value over the medium to long term, we use sales and operating income, which are the Company’s main management indices, as key performance indicators (KPIs). The amount of the bonus will fluctuate according to the degree by which these targets have been achieved, while taking into consideration also non-financial indicators.

- Non-financial indicators are based on the degree of achievement of the various roles of the corporate executive, such as implementing measures to realize the medium-term plan, engagement in CSR management, and the development of human resources (succession training). The Remuneration Committee determines the amount of remuneration based on such evaluation.

- Taking into account both financial and non-financial indicators, the final amount paid as a bonus will vary between 0% and 150%.

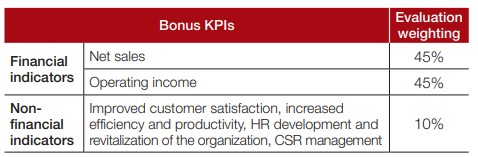

- Remuneration is designed so that the higher the officer’s position, the higher the weighting of financial indicators. As an example, the KPIs and their respective evaluation weightings for the president and CEO are as follows.

- In principle, stock-based compensation is paid to the corporate executive following retirement from the current position, with the aim of continuous enhancement of enterprise value while sharing value with shareholders.

- A base amount for stock-based compensation is set for each position. Of this, 50% is performance-linked and 50% is not.

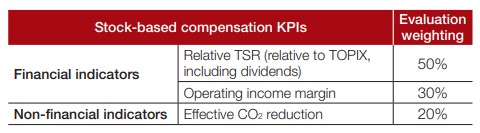

- As regards KPIs, the performance-linked component uses relative total shareholder return (TSR)—an indicator that evaluates our TSR relative to the Tokyo Price Index (TOPIX) by the Tokyo Stock Exchange—to ensure that officers and shareholders have a shared interest, and operating income margin, an indicator set forth in the medium-term plan. As a non-financial indicator, we use effective CO2 reduction at customers’ sites, which is one of the essential goals of the azbil Group for the SDGs. The performance-linked component will vary between 0% and 150% depending on the extent to which these targets have been achieved during the period covered by the medium-term plan. The evaluation weightings for each KPI are as follows.

- As a way to further encourage value sharing with shareholders, the non-performance-linked component is paid as stock-based compensation with vesting of a fixed number of shares.

- Stock-based compensation is paid through a trust-type stock compensation plan. Under this plan, points corresponding to an officer’s position are awarded annually, and Company shares equivalent to the number of points accumulated are transferred from the trust to the plan-eligible person following retirement from the current position.

(1) Basic remuneration

- Basic remuneration is paid as a fixed monthly monetary sum based on the responsibilities of the position.

- In principle, stock-based compensation is paid to the director following retirement from the current position, with the aim of continuously enhancing enterprise value while sharing value with shareholders.

- A base amount of stock-based compensation is determined, which is entirely non-performance-linked.

- Stock-based compensation is paid through a trust-type stock compensation plan. Under this plan, a certain number of points are awarded annually to those eligible, and Company shares equivalent to the number of points accumulated are transferred from the trust to the plan-eligible person following retirement from the current position.

Process for determining remuneration

- The Remuneration Committee determines the remuneration of directors and corporate executives. The majority of the members of the Remuneration Committee, including the chairperson, are outside directors, which ensures objectivity and transparency.

- The Remuneration Committee has the authority to determine the details of remuneration for individual directors and corporate executives. It arrives at evaluation decisions based primarily on (1) the policy governing remuneration details for individual directors and corporate executives; (2) the details of remuneration for individual directors and corporate executives; and (3) in the case of corporate executives, the degree of achievement of both company-wide performance targets and the individual targets set for each corporate executive for the purpose of determining performance-based remuneration.

- In the event of a substantial change in the external environment of the Company, the Remuneration Committee, after carefully deliberating on the appropriateness of the target values and calculation methods used for determining performance-linked remuneration, may take exceptional measures.

Non-payment of stock-based compensation

- If it is determined that an officer is responsible for serious misconduct or a serious violation, the Company can deny all or part of the Company shares, etc. that were to be transferred to the officer under the stock-based compensation plan.

Disclosure policy

- In accordance with our disclosure policy and applicable laws and regulations, details of the executive remuneration system are compiled and disclosed promptly and proactively through the annual Securities Report, reference materials for the General Meeting of Shareholders, the Business Report, the Corporate Governance Report, company website, etc. The Company also implements a policy of active engagement with shareholders and investors.

Contribution of Outside Directors

In addition to the requirements for independent officers stipulated by the Tokyo Stock Exchange, we follow criteria for independence that we have formulated when appointing outside officers as prescribed by the Companies Act. Candidates deemed capable of providing constructive suggestions and accurate observations and advice concerning the company’s business and the improvement of enterprise value in the medium and long terms are appointed as outside directors. Our outside directors, from their diverse perspectives, are active in asking questions and giving suggestions at Board of Directors meetings, thereby contributing to sustainable corporate growth and the enhancement of enterprise value over the medium and long terms.

Reasons for Appointing Outside Directors and Their Attendance Record in FY2022

Takeshi Itoh

In addition to management experience and experience as an analyst in investment banks and investment advisory companies, etc. in Japan and abroad, with his long-term overseas work experience and experience in the consulting business including fundraising and M&A advice, he has a record of superior performance in advanced corporate analysis. In addition, by utilizing aforementioned experiences, at Board of Directors meetings of the Company, he not only supervises business execution but also proactively offers his opinions based on his advanced knowledge and experience, and also from the perspective of the capital markets, as an expert in the fields of international financing and investment, to increase the transparency and fairness of management. In these ways, he fulfills such appropriate roles as supervision and advising, etc. on business execution.

Attendance record: Board of Directors meetings 12 of 12

Waka Fujiso

She possesses extensive knowledge and experience that she gained mainly during her activities over many years as a public prosecutor, and, after retiring from the position of public prosecutor at the Supreme Public Prosecutors Office, during her service as a council member at a government agency at which time she also taught at a law school. At Board of Directors meetings of the Company, she not only supervises business execution, but also proactively offers opinions from the perspectives of sustainability and CSR, based on her extensive knowledge as a legal expert, aiming at more thorough compliance management and risk management as well as the enhancement of management transparency and fairness. In these ways, she fulfills such appropriate roles as supervising and giving advice on business execution.

Attendance record: Board of Directors meetings 12 of 12

Mitsuhiro Nagahama

He possesses broad knowledge and extensive experience in corporate management, financial/securities sectors and global business, as he has successively served in important posts at financial institutions. He was appointed as an outside member of the Audit & Supervisory Board in 2015, and has audited the Company’s overall business with his outstanding insights on corporate governance and company management. Furthermore, he has not only supervised business execution as an outside director since 2019, but also proactively offered opinions to enhance management transparency and fairness from the perspective of the capital markets and based on a global perspective. In these ways, he fulfills such appropriate roles as supervising and giving advice on business execution.

Attendance record: Board of Directors meetings 12 of 12

Anne Ka Tse Hung

She worked at an international law office as a partner attorney, and supported the conclusion of international transaction agreements for Japanese companies in addition to overseas corporate matters. She also has business experience with many Japan-based companies, is familiar with Japanese business customs, and possesses knowledge in the industry to which the Company belongs. At Board of Directors meetings, she draws on her expert knowledge of international business not only to supervise business execution, but also to proactively offer opinions based on her approach to business promotion system and investment for international business growth and a global perspective. In these ways, she fulfills such appropriate roles as supervising and giving advice on business execution.

Attendance record: Board of Directors meetings 12of 12

Minoru Sakuma

He has successively served in important posts at policy-based financial institutions, and in addition to his broad knowledge of international finance and extensive overseas experience, he has management experience at investment corporations and experience as an outside member of the Audit & Supervisory Board at an engineering company with worldwide operations. In 2019, he assumed the post of outside member of our Audit & Supervisory Board, and audited Azbil Corporation’s business in general, since 2022 he has contributed to the improvement of the Company’s corporate governance and internal control as Director (Audit committee Member). In addition, in the Company’s meetings of the Board of Directors, he offers opinions regarding the appropriateness of the Company’s business strategies, and from the perspective of enhancing the Group’s overall corporate governance. Moreover, he has knowledge of finance, accounting, and legal affairs, as well as knowledge of global business. In these ways, he fulfills such appropriate roles as supervising and giving advice on business execution.

Attendance record : Board of Directors meetings 12 of 12

Fumitoshi Sato

He has successively served in important posts at the Bank of Japan, and in addition to his broad knowledge in the financial sector and extensive experience, he has work experience in the management division at an operating company in the manufacturing industry—overseeing accounting, legal affairs, and human resources—and management experience as a director. In 2019, he assumed the post of outside member of our Audit & Supervisory Board, and audited the Company’s business in general, and since 2022 he has contributed to the improvement of the Company’s corporate governance and internal control as Director (Audit Committee Member). In addition, in the meetings of the Company’s Board of Directors, he offers opinions regarding the appropriateness of the Company’s business and financial strategies, and from the perspective of risk management and corporate governance enhancement. Moreover, he has knowledge of finance, accounting, and legal affairs, as well as knowledge of corporate management. In these ways, he fulfills such appropriate roles as supervising and giving advice on business execution.

Attendance record : Board of Directors meetings 12 of 12

Shigeaki Yoshikawa

He has held key positions in a general trading company with global operations, and has broad knowledge and abundant experience regarding overseas business development and business portfolio strategies, as well as corporate management experience, etc., at a think-tank consulting firm. He assumed the post of Outside Director of the Company in 2022, and has proactively offered his opinions regarding the Company’s international business strategies, approach to business strategies for growth and human resource development based on his extensive experience and insight into overseas business, as well as his knowledge of marketing and sales. In these ways, he fulfills such appropriate roles as supervising and giving advice on business execution.

Attendance record : Board of Directors meetings 12 of 12

Tomoyasu Miura

He has held key positions at a think-tank consulting firm and possesses extensive knowledge and experience in a wide range of fields, such as IT, technology innovation, and new business creation, as well as abundant experience in the development of HR management at a public interest incorporated foundation. He assumed the post of Outside Director of the Company in 2022, and has proactively offered his opinions from the perspectives of business strategies for the Company’s growth, IT and technology based on his abundant knowledge of the IT and technology domains, his experience of new business creation, and his experience of human resource development. In these ways, he fulfills such appropriate roles as supervising and giving advice on business execution.

Attendance record : Board of Directors meetings 12 of 12

Comment by an Outside Director

Azbil corporate governance, present and future

Outside Director

Fumitoshi Sato