with azbil

azbil MIND

New incentive scheme under the employee stock ownership association plan to foster a sense of engagement in management among employees

New incentive introduced to the employee stock ownership association plan to support employees in building their assets, enhance enterprise value, and foster employee awareness toward enterprise value.

Azbil considers the growth of each employee to be a driving force for enhancing enterprise value and actively improves human capital. In 2022, we introduced the Trust-Type Employee Shareholding Incentive Plan (E-Ship®) as a new plan with enhanced incentives for employees based on the long-run employee stock ownership association plan. It allows the company to support employees, who participate in the employee stock ownership association at their will, in building their assets as part of employee benefits, contributing to the enhancement of enterprise value, and fostering employee awareness toward enhancing enterprise value.

New shareholding framework that contributes to improving human capital

The azbil Group provides automation-related products and services to achieve growth and enhance enterprise value while contributing “in series” to a sustainable society. As part of the measures for human capital that supports such efforts, Azbil Corporation introduced the Employee Stock Ownership Plan (J-ESOP [stock grant-type ESOP*1]) and the Trust-Type Employee Shareholding Incentive Plan (E-Ship®*2 [employee stock ownership plan-based ESOP]) to improve human capital and help both the company and employees achieve sustainable growth. These plans serve as employee benefits and aim to encourage each employee to enhance enterprise value and awareness toward it. Following the previous article on the employee stock ownership plan, this article presents the enhanced employee stock ownership association plan among stock-related plans.

Since 1977, Azbil has been operating the employee stock ownership association plan through the stock ownership association. In this plan, employees who spontaneously participate in the stock ownership association contribute a certain amount from their salary, to which the company adds a 10% incentive to purchase Azbil’s shares. The purchased shares are managed under the name of the stock ownership association and allotted to the member employees depending on their contribution amount; additionally, dividends from the shares are reinvested. The company has established such plan over the years to support employees in building their assets and fostering a sense of engagement in management from the viewpoint of shareholders.

In 2022, the company introduced the Trust-Type Employee Shareholding Incentive Plan (E-Ship®) to replace the conventional plan. It has evolved into a shareholding framework that further enhances enterprise value in the medium-to-long term while helping employees build their assets.

Evolving employee stock ownership association plan, with incentives that increase employees’ awareness

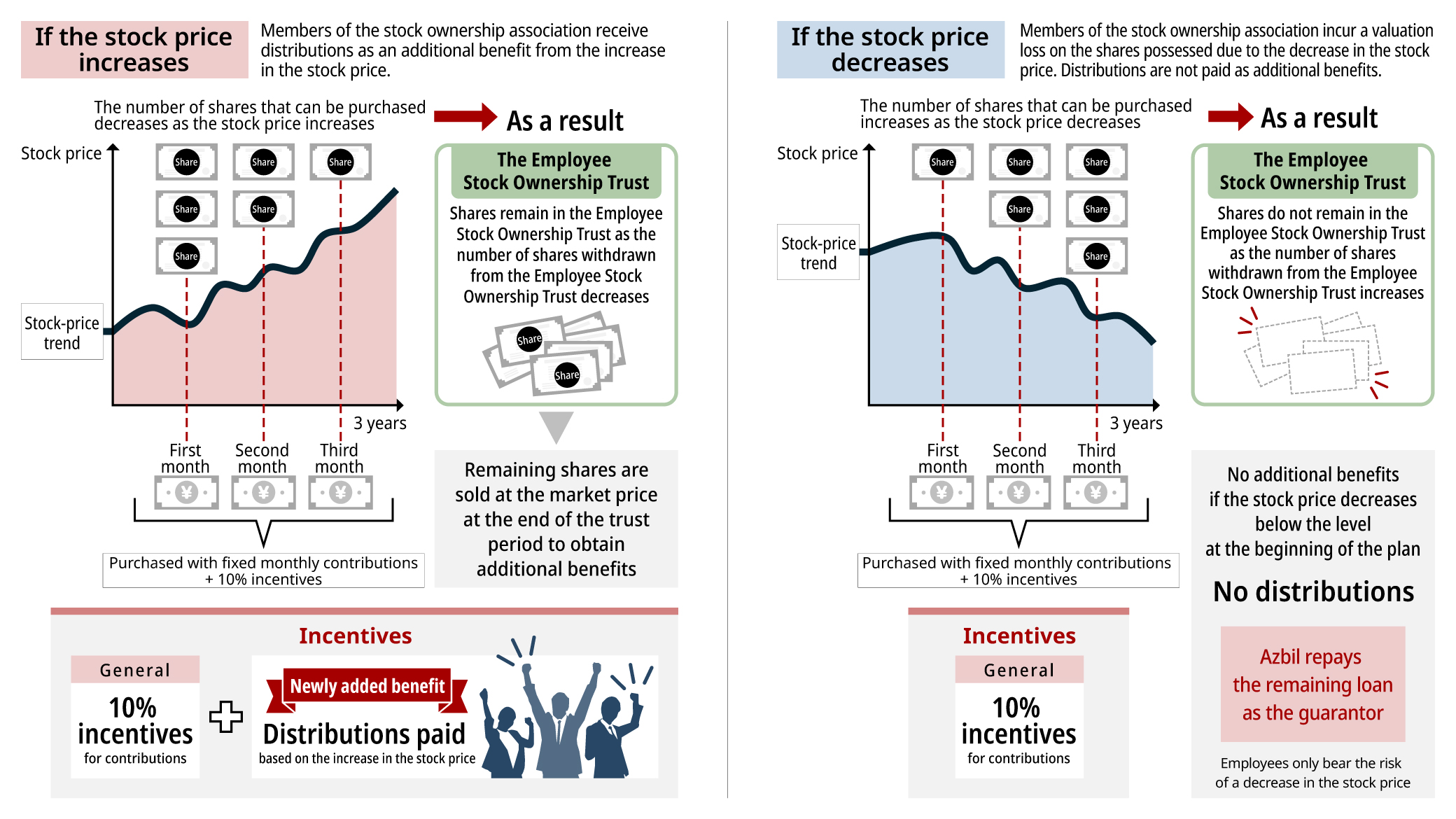

Newly introduced over three years from May 2022 to May 2025, the E-Ship® provides further incentives beyond the conventional employee stock ownership association plan. Although the basic structure of the stock ownership association remains the same, if the company’s stock price increases at the end of the period, then the member employees can receive distributions based on the number of shares accumulated during that period.

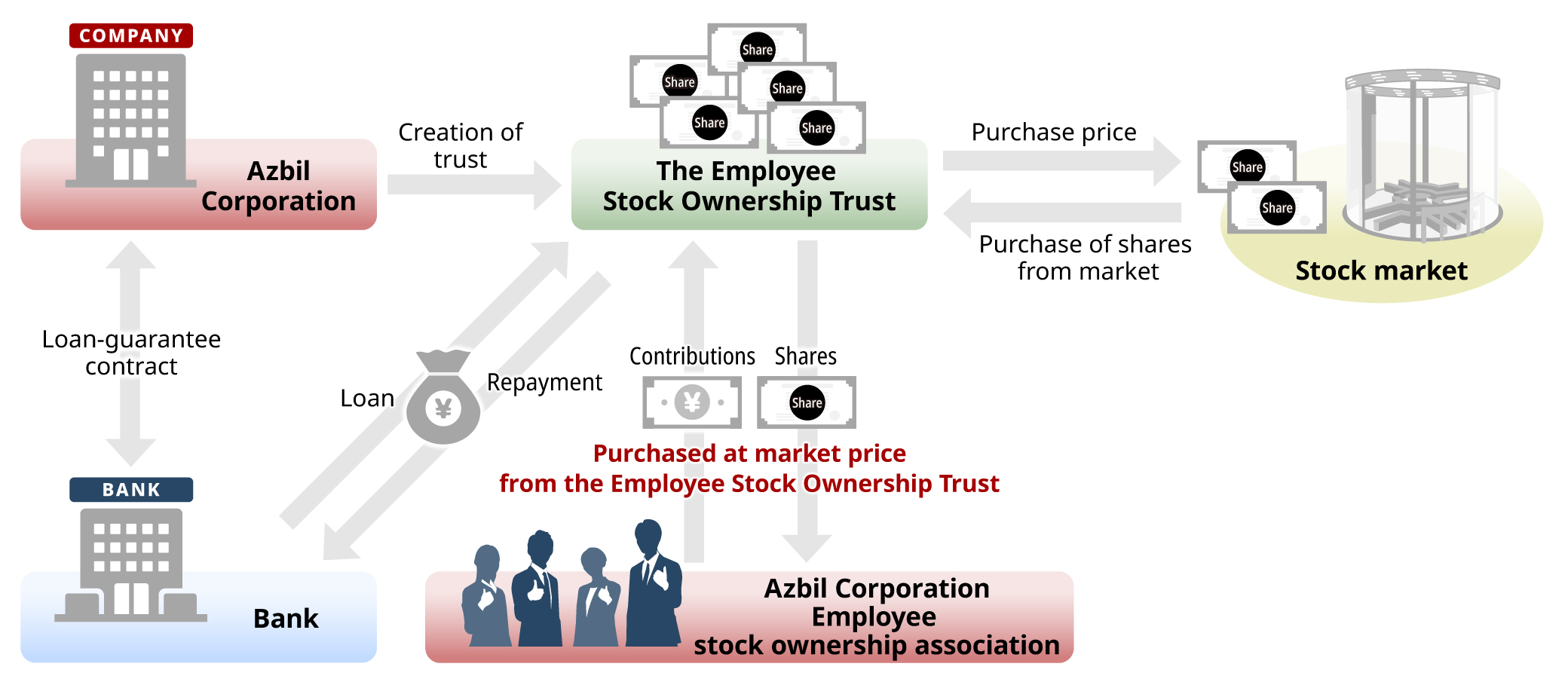

The plan authorizes a “Trust Fund for the azbil Group Employee Stock Ownership Association” (the “Employee Stock Ownership Trust” ) through a trust bank, with its members as the beneficiary. The Employee Stock Ownership Trust obtains the necessary funds for purchasing the company’s shares from the bank, with Azbil as the guarantor, and purchases the number of Azbil shares the employee stock ownership association is expected to purchase during the trust period from the stock market in advance.

Meanwhile, the employees contribute a certain amount from their salary every month, to which the company adds a 10% incentive to purchase Azbil shares from the Employee Stock Ownership Trust at the market price. The monthly contribution amount is fixed unless the number of units is changed. Therefore, if the stock price increases, then the number of shares that the members can purchase will be lower than initially expected and shares equivalent to the amount of proceeds from sales of shares will remain in the trust as remaining assets. These remaining shares are sold at the market price at the end of the three-year trust period and serve as the source of distributions. Cash gained by sales of the remaining shares, etc. is distributed to the members depending on the number of shares accumulated during the trust period.

During the trust period, the Employee Stock Ownership Trust sells purchased shares to the employee stock ownership association at the market price every month and repays the bank loan using the sales proceeds and share dividends. If the stock price decreases below the purchase price and the loan remains at the end of the trust period, then Azbil will repay it as the guarantor. Therefore, member employees of the stock ownership association only bear the risk of a decline in the stock price (almost the same as in the case of a normal stock ownership association).

Furthermore, Azbil newly introduced the special incentive scheme in February 2025 to encourage employees to participate in the stock ownership association. This scheme grants 40 shares of Azbil to all new and existing members of the stock ownership association. Regarded by employees as an additional incentive in addition to the existing benefits, such as 10% company incentives for contributions, profits from the increase in the stock price, and E-Ship® distributions, the new special incentive has primarily promoted new membership to the stock ownership association. In fact, the association participation rate increased from approx. 51% (as of February 2025 before introduction) to approx. 71%.

Additionally, the company has decided to re-introduce E-Ship® for approx. three years from May 2025 to June 2028 to continue allowing employees to receive incentives for enhancing enterprise value (= increase in the stock price).

Fostering a sense of ownership as shareholders among employees for sustainable enhancement of enterprise value

E-Ship® provides an opportunity for employees to own their company’s shares at their will, with additional incentives beyond those offered by the conventional employee stock ownership association plan. It promotes the increased engagement and motivation of employees and facilitates collaboration between the company and employees to achieve higher enterprise value. Whereas the Japanese Employee Stock Ownership Plan- Restricted Stock (J-ESOP-RS*3) grants the company’s shares to all employees, E-Ship® distributes cash based on the number of shares purchased with the free-will participation of the employees. Thus, the company supports the employees in building their assets and achieving financial stability.

Spontaneous participation in a plan such as E-Ship® encourages the employees to become more conscious of working for a listed company and to recognize how their own work contributes to enhancing enterprise value. Such change in consciousness enhances the sense of responsibility and ownership as well as reinforces the company-employee relationship and governance, which is favorably received by shareholders and institutional investors.

Through E-Ship®, Azbil has been balancing between improving employee engagement and asset building to contribute positively to both the company and employees. We will continue to promote initiatives that support employees’ growth as part of human-capital improvement efforts such that the company and employees can collaborate in enhancing enterprise value sustainably.

* E-Ship® is a registered trademark of Nomura Securities Co., Ltd.

*The program shared in this article has been introduced only to Azbil Corporation, and not to the other Group companies.

- *1: Employee Stock Ownership Plan (ESOP)

A system in which a company uses its own funds to acquire the company’s shares and grants them to eligible employees as incentives. - *2: Trust-Type Employee Shareholding Incentive Plan (E-Ship®)

Japan’s first employee incentive plan that applies the employee stock ownership association system, developed by Nomura Securities Co., Ltd. and Nomura Trust and Banking Co., Ltd., based on the Employee Stock Ownership Plan (ESOP), which is popular in the United States. - *3: Japanese Employee Stock Ownership Plan-Restricted Stock (J-ESOP-RS)

A benefit plan designed to provide incentives for the sustainable enhancement of enterprise value by allocating common shares with transfer restrictions to employees, thereby aligning their perspective with that of shareholders. - *This article was translated from the Japanese version of the article published on June 20, 2025.

Related information

Related information