with azbil

azbil MIND

Strengthening employee engagement through human capital enhancement measures utilizing the Company's own stock

With the introduction of the J-ESOP-RS employee stock ownership plan, both employees and the Company will work together to enhance enterprise value

The azbil Group regards human capital enhancement as a key management strategy and promotes health and well-being management that supports employees’ physical and mental health while fostering job satisfaction. As part of these efforts, Azbil is advancing the adoption and revision of the Employee Stock Ownership Plan (J-ESOP) and the Trust-Type Employee Shareholding Incentive Plan (E-Ship®) to encourage employee share ownership and further enhance employee welfare. These programs aim to enhance sustainable enterprise value by encouraging employees to contribute to the Company. They also support employees in building financial assets and are expected to assist in securing a stable life after retirement.

Strategically strengthening human capital by expanding stock ownership programs through employee benefits

The azbil Group views human resources as the foundation of enterprise value creation and actively promotes the strengthening of human capital to foster collaboration between employees and the Company in enhancing enterprise value. This is part of the azbil Group’s efforts to continuously grow as a company that has value for society and to contribute to building a sustainable society. The azbil Group announced the “azbil Group Health and Well-Being Declaration*1” in 2019 as the foundation of this approach, clearly expressing its commitment to actively collaborating with its employees to create a comfortable and easy-to-work-in environment and to promote both physical and mental health. These initiatives have now evolved into broader measures focused on achieving well-being, and efforts are ongoing to further strengthen them.

As part of its efforts to strengthen human capital, Azbil Corporation has introduced an Employee Stock Ownership Plan (J-ESOP [stock grant-type ESOP*2]) and an Trust-Type Employee Shareholding Incentive Plan (E-Ship®*3 [employee stock ownership plan-based ESOP]) to enable the Company and its employees to achieve sustainable growth together. These plans are part of Azbil's employee benefits package, designed to encourage employees to hold company stock. Azbil is actively promoting reforms to the plans. In 2017, the Company launched J-ESOP, a plan to grant employees Company stock, and in 2025, it revised this plan to J-ESOP-RS*4. In addition, in 2022, it launched E-Ship®, a plan based on the employee stock ownership association system.

Few companies have implemented both ESOP plans in parallel, highlighting a strong commitment to enhancing employee engagement and returning profits to employees. This structure enables employees to hold a substantial number of Company shares, fostering a sense of ownership and encouraging both the Company and its employees to pursue growth together. These plans are also well received by shareholders and institutional investors.

New J-ESOP-RS plan introduced to reward employee contributions with stock

The Employee Stock Ownership Plan (J-ESOP) was introduced in May 2017 as a means of returning value to employees in line with the Company’s efforts to enhance enterprise value. This plan provides all Azbil employees with incentives in the form of Company stock. A trust bank commissioned by Azbil will acquire, in advance, shares from the market for future distribution to employees, and will also accept and manage Azbil’s treasury shares. This is a plan to provide shares managed by a trust bank to all employees over time.

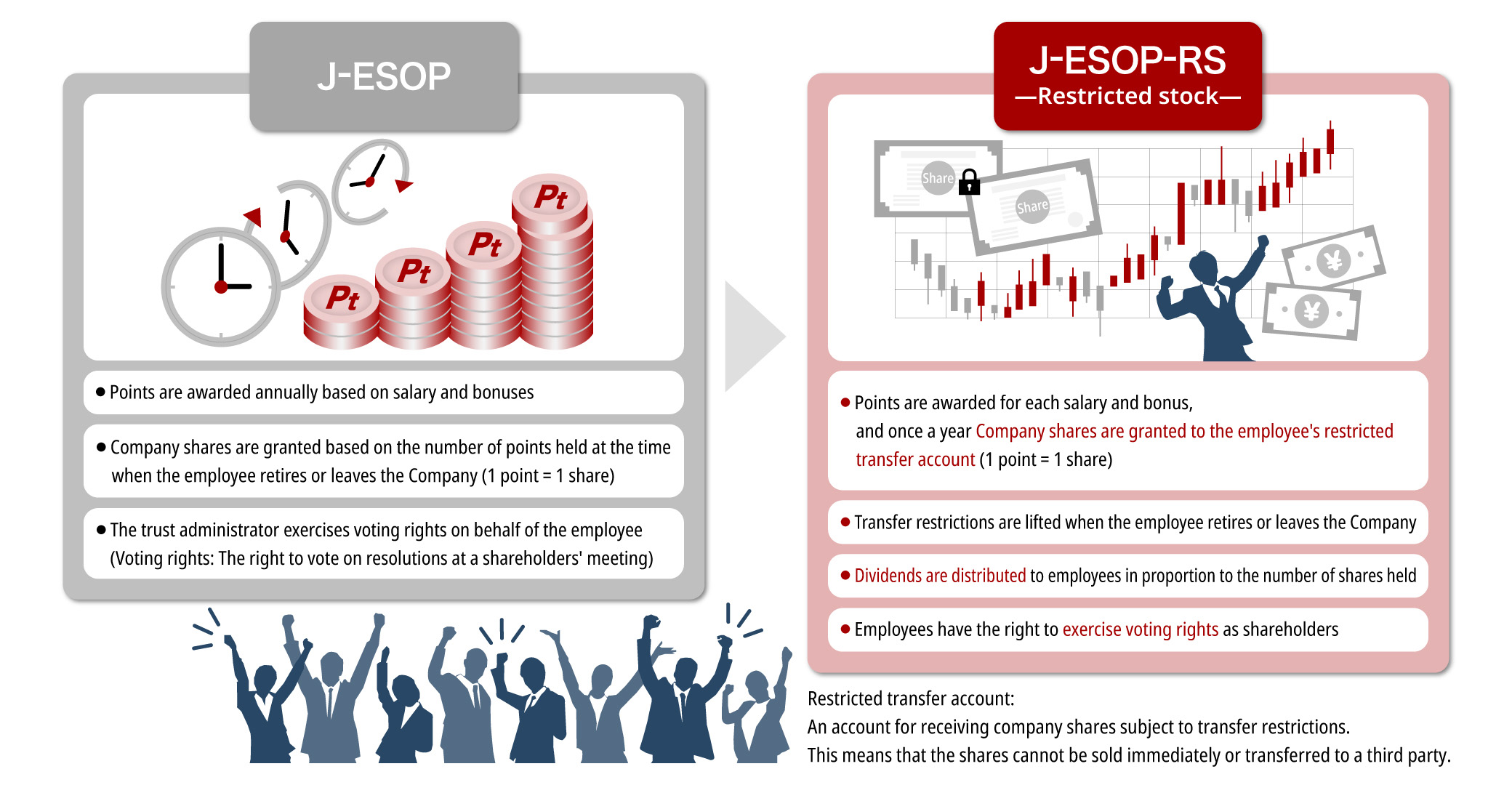

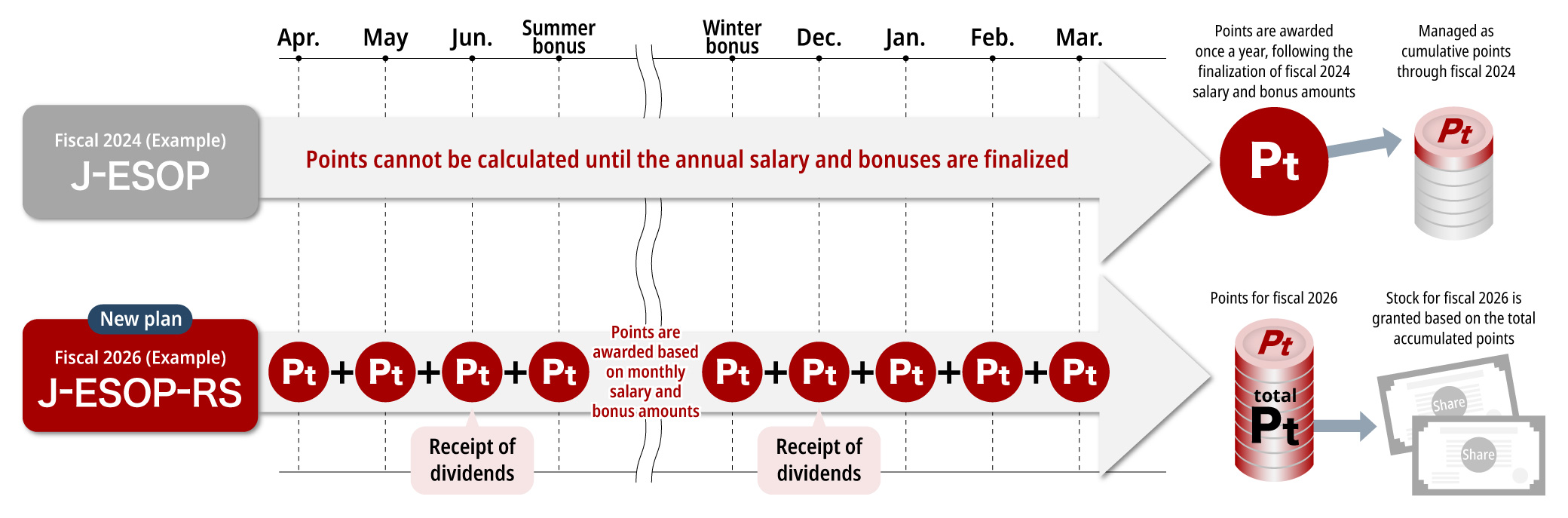

When J-ESOP was first introduced in 2017, it adopted a system in which points were awarded annually based on factors such as employee performance, salary, and bonuses. Points are accumulated and managed each year until the employee retires or leaves the Company. Then, depending on the number of points accumulated, shares would be awarded when the employee retires or leaves the Company.

The plan was subsequently revised in April 2025 and renamed J-ESOP-RS. Under the new plan, points are awarded monthly based on salary and bonus amounts, and once a year, Company shares corresponding to the accumulated points are granted to employees during their employment. The shares granted are managed in restricted transfer accounts and cannot be sold until the employee retires or leaves the Company. Despite these transfer restrictions, ownership remains with the employees, who are entitled to receive dividends from the date of grant proportional to the number of shares held. Employees holding 100 shares or more have the right to exercise voting rights as shareholders. This is expected to strengthen employees' sense of ownership of the Company and awareness of the importance of enhancing enterprise value, as well as deepen their interest in and understanding of the Company's growth and management from the perspective of shareholders.

Furthermore, under J-ESOP-RS, since transfer restrictions on Company shares are lifted in a lump sum when the employee retires or leaves the Company, the shares are treated as retirement income. Therefore, as such shares are subject to retirement income deductions, employees will enjoy a lower tax burden than they would with salary income.

Encouraging employees to contribute to enhancing enterprise value and fostering a sense of engagement in management, which in turn helps them build financial assets

There are various advantages to granting Company shares to employees through such initiatives. First, when the company performs well and its stock price rises, the value of the shares held by employees increases, which in turn boosts their motivation to work. In addition, employees can see that their own efforts and achievements are reflected in the enterprise value, which fosters a sense of ownership toward the company's management and growth. By becoming shareholders, employees gain a deeper understanding of the company’s financial health and social standing, while also becoming more conscious of how their actions impact the organization as a whole. This shift in awareness also strengthens governance and heightens compliance awareness, supporting the development of a corporate culture grounded in ethical conduct. Furthermore, enabling employees to build financial assets through stock ownership not only helps alleviate anxiety about the future and provides economic stability, but also contributes to their sense of fulfillment by allowing them to feel that they are contributing to the corporate activities of a good company recognized by society.

Through initiatives that encourage employee share ownership, enhance enterprise value, and improve employee welfare, Azbil is strengthening employee engagement. We are building a system that fosters a virtuous cycle in which employees and the Company grow together while driving enterprise value. In addition, as a new initiative under the employee stock ownership association plan, we have introduced an incentive plan called E-Ship® to further return value to our employees. We will introduce details of this initiative in the article “New incentive scheme under the employee stock ownership association plan to foster a sense of engagement in management among employees.”

* E-Ship® is a registered trademark of Nomura Securities Co., Ltd.

*The program shared in this article has been introduced only to Azbil Corporation, and does not apply to the other Group companies.

- *1: Health and Well-Being Declaration

In July 2019, the azbil Group defined its comprehensive initiatives for work style reform, diversity promotion, and enabling employees to work healthily and energetically as “Health and Well-being Management” and announced the “azbil Group Health and Well-Being Declaration.” - *2: Employee Stock Ownership Plan (ESOP)

A system in which a company uses its own funds to acquire the company’s shares and grants them to eligible employees as incentives. - *3: Trust-Type Employee Shareholding Incentive Plan (E-Ship®)

This is Japan's first employee incentive plan that applies the employee stock ownership association system, developed by Nomura Securities Co., Ltd. and Nomura Trust and Banking Co., Ltd., based on the Employee Stock Ownership Plan (ESOP) that is popular in the United States. - *4: Japanese Employee Stock Ownership Plan- Restricted Stock (J-ESOP-RS)

A benefit plan designed to provide incentives for the sustainable enhancement of enterprise value by allocating common shares with transfer restrictions to employees, thereby aligning their perspective with that of shareholders. - *This article was translated from the Japanese version of the article published on May 28, 2025.

Related information

Related information