Interview with the CEO

Kiyohiro Yamamoto

Director, Representative Corporate Executive, President & Group Chief Executive Officer

- Q1. What changes in the business environment have you been aware of recently?

- Q2. What is your assessment of the course of the previous medium-term plan (FY2021-FY2024)?

- Q3. What were the key points when setting targets for the new medium-term plan (FY2025-FY2027) and when revising long-term targets for FY2030?

- Q4. Please describe the azbil Group's unique business model.

- Q5. What points will you be focusing on in investments to strengthen the azbil Group's unique business model?

- Q6. How will you expand overseas markets?

- Q7. What is your approach to strengthening the management foundation for supporting sustainable growth?

- Q8. What will you be focusing on in business operations and in initiatives to achieve business growth?

Q1. What changes in the business environment have you been aware of recently?

A1. Generative AI and other recent changes in the business environment will contribute to expanding the role and value of the automation business.

In recent years, there have been sweeping changes in the business environment. As well as geopolitical and supply chain risks, initiatives targeting carbon neutrality are accelerating, and the GX market is expanding. Other changes involve the growing prominence of societal issues, such as labor shortages and soaring personnel expenses. There are also new technological trends, such as generative AI. These changes in the business environment pose a risk if we do not respond appropriately, but they also offer us business opportunities, because using automation technology to solve our customers’ issues is central to our work.

To ensure the sustainability of society, every organization that supports it must not only engage in solving the quotidian issues that affect society but also introduce new technologies. The azbil Group is capable of sustainably providing solutions that not only support essential functions—such as facility operation, monitoring, diagnosis, and optimization—but also incorporate the latest technologies. Because automation has such a significant role to play in ensuring the sustainability of society, we will be able to grow as a company while contributing to society. My firm belief in this was reinforced by what I witnessed when we implemented various initiatives under the previous medium-term plan.

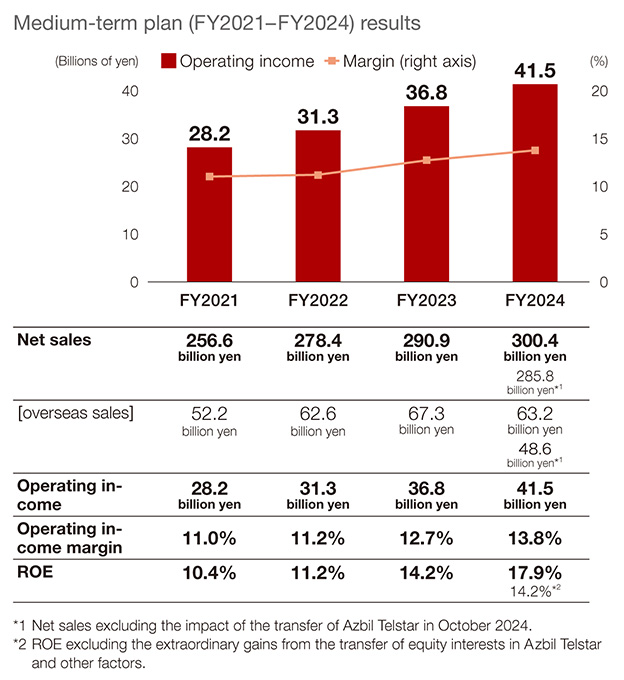

Q2. What is your assessment of the course of the previous medium-term plan (FY2021-FY2024)?

A2. Achieved growth in net sales and profits for the fourth consecutive fiscal year, as well as our highest-ever financial results.

One issue going forward is how to achieve further sustainable growth.

Over the four years of the previous medium-term plan, we made steady progress with our businesses despite rapid changes in the environment, and we implemented significant work style reforms. We worked to strengthen profitability, implementing cost pass-through, while also decisively responding to customer demand by augmenting procurement and production systems. Consequently, we achieved our highest-ever results. Moreover, we have achieved growth in both net sales and profits for four consecutive years. In FY2024, we exceeded the initial targets for net sales, operating income, operating income margin, and ROE. In particular, profitability improved substantially. Being conscious of the cost of capital, we made progress with restructuring our business portfolio. In the Life Automation business, we transferred Azbil Telstar, S.L.U. to Syntegon, a German company.

We thus made steady progress with the previous medium-term plan. At the same time, the issue of how to achieve further sustainable growth grew more pressing. To achieve sustainable growth while responding to changes in the business environment and addressing emerging needs, we will strive to strengthen the azbil Group’s unique business model by actively investing in human capital, product competitiveness, and DX. We will also consider collaboration with other companies, including M&A, to address increasingly advanced, complex, and diversified needs.

We have been advancing various measures aimed at expansion in overseas markets, but in order to achieve additional business expansion, I think we must further invest in resources, including personnel, while also enhancing our organizational systems so we can implement appropriate, timely measures that are tailored for each region.

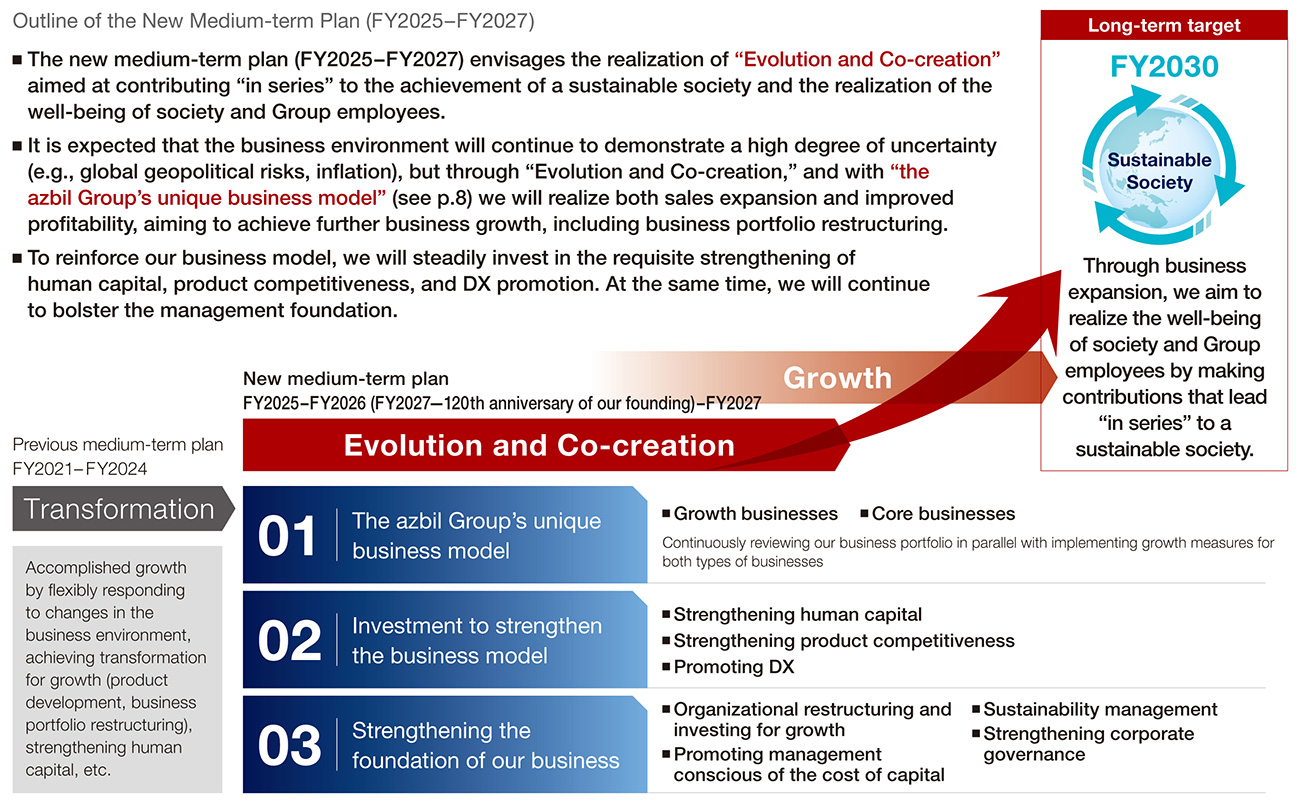

Q3. What were the key points when setting targets for the new medium-term plan (FY2025-FY2027) and when revising long-term targets for FY2030?

A3. Pursuing sales growth as well as improving profitability in the new medium-term plan, while revising upward our targets for FY2030

We expect the business environment to continue changing, but under the new medium-term plan (FY2025–FY2027) we will use the azbil Group’s unique business model to achieve both sales growth and improved profitability, building on the results of the previous medium-term plan. We are aiming for sales growth greater than what we achieved up to FY2024. As regards profits, while investing for future growth, we plan to achieve, three years ahead of schedule, an operating income margin of 15%, which was our long-term target under the previous medium-term plan.

At the same time, we have upwardly revised our FY2030 long-term targets for both net sales and profits. This reflects our firm belief that we will be able to achieve further growth not only supported by our core businesses, in which we can expect stable and continuous demand thanks to our long-established customer base but also by developing growth areas.

Growth areas are fields that require technological innovation—in semiconductors and data centers, for example—as well as those focused on solving societal issues, such as the challenges of attaining carbon neutrality and handling labor shortages. As specific examples, in the Building Automation business we will expand business in the thriving domestic market by offering high value-added systems and services, such as GX solutions. At the same time, overseas we will also deploy our domestic business model, in which we provide equipment, systems, and services throughout a building’s life cycle. In addition, we will take steps to make operations more efficient, such as introducing products with simpler installation requirements. In the Advanced Automation business, we will develop products and services tailored to new demands for measurement and control, and launch them in domestic and overseas markets. In the Life Automation business, we will aim for further growth from the development and sale of next-generation smart meters, as well as from expanding our smart metering as a service business.

The new medium-term plan covers a period in which we will be making significant investments to achieve sustainable growth, with a view to achieving our long-term targets for FY2030 and beyond. With the business environment expected to remain in flux, now is exactly the right time for us to focus in earnest on measures for future growth.

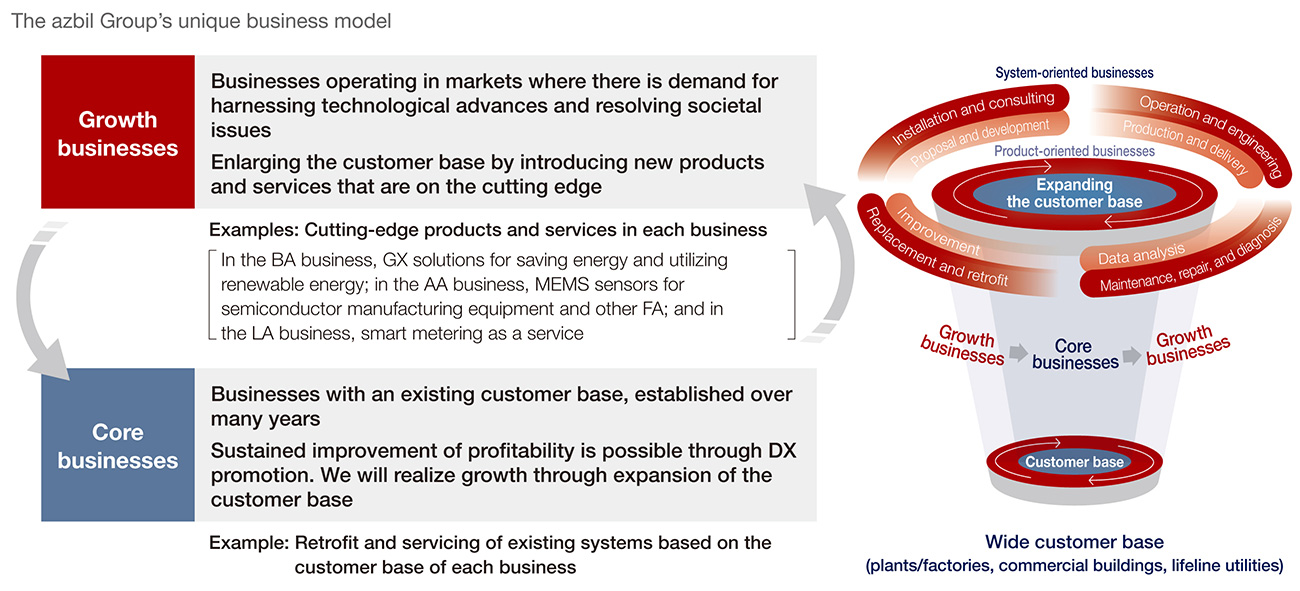

Q4. Please describe the azbil Group's unique business model.

A4. Achieving sustainable business expansion with the azbil Group’s unique business model, based on a cycle comprising core businesses and growth businesses

In the recently announced new medium-term plan, we have redefined the azbil Group’s unique business model, which is based on a cycle comprising core businesses and growth businesses. This reflects our understanding of what kind of initiatives are needed to contribute, through business expansion, to the well-being of society and our employees by contributing “in series” to the achievement of a sustainable society amid unabated change in the business environment. With substantial changes occurring in our environment, to continue operating as a group it is essential that we have a business foundation that is resistant to such changes while at the same time pursuing business growth based on the opportunities that result from changes in society. It was when I took a fresh look at the Group’s businesses from this perspective that I understood that the azbil Group’s unique business model is now established.

Current azbil Group businesses can be broadly divided into two categories: one is recurring or core businesses, and the other is growth businesses. An advantage we have is that our extensive customer base covers factories, commercial buildings, and lifeline utilities—meaning that we are not easily affected by changes in a specific market. In our core businesses—which have broad, stable customer bases with strong relationships developed over many years—we can constantly maintain and enhance profitability using DX and other technologies to provide products and services that will contribute to solving new issues. Our growth businesses find new opportunities in technological innovation, such as semiconductors, and societal issues, such as carbon neutrality. We can work to develop and expand the customer base by introducing cutting-edge products and services to new customers, not just in Japan but also overseas.

Our business model is based on a cycle: As we expand the customer base in our growth businesses, we improve sustainability and profitability in our core businesses, which leads to the creation of the next growth business (growth businesses ⇒ core businesses ⇒ growth businesses). The fact that we can use this cycle to achieve sustainable business expansion is one of the key characteristics and strengths of the azbil Group, which integrates everything from development and production to consulting, engineering, and maintenance services. We have long been engaged in this process and have now defined it as the “azbil Group’s unique business model,” which we aim to further strengthen.

To further strengthen the azbil Group’s unique business model, we must ourselves undergo change to adapt to changes in the environment. In other words, we must “evolve.” Over the course of the new medium-term plan, we will actively invest in such evolution. However, in a world of change it will not be enough for us merely to evolve.

We will thus collaborate with external partners, on an equal footing, utilizing our respective strengths as we engage in the “co-creation” of new value. This will include providing the means to enhance the sustainability of society as a whole. This is the concept behind the major theme of our new medium-term plan: “Evolution and Co-creation.”

Q5. What points will you be focusing on in investments to strengthen the azbil Group's unique business model?

A5. Actively investing in three areas: human capital, product competitiveness, and DX promotion

To further strengthen the azbil Group’s unique business model and achieve sustainable growth, we will actively make necessary investments over the three years covered by the new medium-term plan. We will focus on three areas: human capital, product competitiveness, and DX promotion.

Human capital is extremely important for the azbil Group, given that we provide solutions using an integrated system, ranging from development and production, to consulting, on-site engineering, and services. First, to expand our growth businesses and core businesses, we will focus on securing and training human resources aligned with the relevant business strategy. In particular, we will work to secure and develop human resources with the ability to offer solutions and human resources ready for active participation in the global arena. We will also enhance our HR systems to ensure that those who generate results and those who perform key functions are able to receive appropriate compensation. In addition, by introducing various incentive plans as part of our investment in human capital, we will create a robust system that enhances employee ownership and engagement, so that the company and employees work together to achieve our targets.

We will accelerate the launch of new offerings (products and services) by investing in product competitiveness. We will develop a range of competitive offerings by further enhancing our proprietary, core measurement and control technologies and our application technologies, which represent azbil’s strengths. Specifically, we will focus on the development of cloud-based services and AI applications, MEMS-based sensing technology, and actuator technology.

We will also emphasize the development of the DX-related products and services required by our customers, while harnessing digital technology to enhance operational efficiency and profitability in areas such as development, manufacturing, engineering, and services. In particular, to enhance productivity and expand our businesses overseas, we will strengthen our infrastructure for providing high-quality services. It is important that these three areas of investment correlate closely and are aligned. It goes without saying that DX is essential for strengthening product competitiveness. Of course, our products are themselves important azbil solutions, but a distinctive characteristic of the azbil Group is the fact that we also create value for the customer with on-site solutions, such as engineering and services. For this reason, strengthening product competitiveness is inseparable from human capital. Furthermore, with AI leading to greater labor-saving and increased efficiency, our approach to investing in human capital will change. Our basic approach to investment under the new medium-term plan will be to steadily achieve sustainable growth by actively investing in these three related areas.

Q6. How will you expand overseas markets?

A6. Globally offering products and services that have been well received in Japan, while building customer trust and a solid track record

In the azbil Group’s businesses, we must supply products and services over the long term. So one distinctive characteristic of our businesses is that expansion is only possible by building customer trust and a solid track record. At present, the azbil Group’s relationships with overseas customers are not yet as robust as they are in Japan. However, our overseas businesses are steadily growing thanks to progress made with product and sales measures, and in each region we are building customer trust and a track record.

In the Building Automation business, we have implemented initiatives aimed at securing contracts from local building owners by drawing on the experience we have gained from overseas projects involving Japanese capital. With the drive to decarbonize and surging energy prices, azbil’s domestic business model, in which we conserve energy throughout a building’s life cycle, has now been well received by building owners overseas as well; it has become a key factor differentiating us from competitors. In the future, we will strive to achieve further growth through such measures as developing global account customers and securing contracts for data centers, a market that is expected to grow, in addition to taking on projects for local building owners.

In the Advanced Automation business, there is emerging and growing demand for solutions to new issues that will ensure the competitiveness of our customers. For example, in the semiconductor manufacturing equipment market there is strong demand for advanced sensors that utilize MEMS technology. Here too we aim to expand business by introducing our automation equipment and systems that utilize the azbil Group’s proprietary technologies and which have a strong track record in Japan.

Products and services that have proved popular in Japan have also been well received by overseas customers. I believe that it is certainly possible to grow our overseas businesses if we take advantage of the azbil Group’s unique business model and offerings (products and services). Measures we can take include further strengthening our sales, engineering, and service systems; promoting DX, to include marketing automation; and expanding customer coverage by rolling out measures that clearly target specific markets and customers.

Q7. What is your approach to strengthening the management foundation for supporting sustainable growth?

A7. Promoting sustainability management, focusing on organizational restructuring and management for growth that is conscious of the cost of capital, and continuing to strengthen corporate governance

To execute our new medium-term plan and achieve sustainable growth by strengthening the azbil Group’s unique business model, we have also been working to enhance various aspects of the management foundation. As part of our organizational restructuring to achieve growth, in April 2025, we established the new Group Management Strategy Department, which is charged with refining our growth strategies and optimizing our business portfolio. Going forward, we will continue promoting organizational restructuring for growth, creating entities for the development and execution of strategies tailored to the unique characteristics of each region overseas. In addition, we will practice management that is conscious of the cost of capital. This includes the adoption of return on invested capital (ROIC) as a company-wide standard for management decisions, and planning for investment in growth that effectively utilizes our balance sheet. Regarding sustainability management, we have set unique goals for the SDGs based on materialities that we have identified, as well as goals in the form of a CSR activity plan that details our approach and the fundamental obligations that we as a company must fulfill to be a member of society. In accordance with these goals, we aim to establish a sustainable business foundation through activities such as promoting CO2 emission reduction, promoting diversity, equity and inclusion, and strengthening our risk management system.

Following our transition to a company with a three-committee board structure in FY2022, we have continued to strengthen corporate governance. In FY2025, we further enhanced the independence and supervisory functions of the Board of Directors, reducing the number of members from 12 to 10, creating a structure in which 70% of directors are outside directors, 30% are women, and the chairperson of the Board is an outside director.

Q8. What will you be focusing on in business operations and in initiatives to achieve business growth?

A8. Aiming to solve issues at customer sites and working with integrity to create value, thereby contributing to the well-being of society and our employees

If I were to choose one word to express the uniqueness of azbil, it would be “integrity.” Beginning with our founding spirit of “freeing people from drudgery,” there have been numerous examples throughout our history that demonstrate azbil’s integrity. One such instance was when we paid patent fees to Brown Instrument Co. as a lump sum after the Pacific War, having been unable to remit the funds in wartime; another example is the 50:50 partnership with Honeywell Inc. The more disruption there is in society, the more important it is to plant one’s feet firmly on the ground and aim for steady progress. For this reason, I think the simplicity of living and working with integrity day by day is important.

In my view, the strengths of the azbil Group lie not only in our development, manufacturing, and sale of products and services that incorporate state-of-the-art technology but also in our ability to work as a partner with our customers, at their sites, to make possible things that they previously thought impossible, in order to solve their issues, and thus create new value. Regardless of how far and how fast AI progresses, there will always be physical, on-site operations. That is why employees who are able to create value on site are extremely valuable.

So that such employees feel a sense of purpose and grow through their involvement in azbil’s businesses, in their own way and from their own standpoint, we must ensure that they understand and share the direction of the azbil Group. To achieve this, we are focusing on enhancing internal communication and strengthening employee engagement. It is also important that the type of value creation that the azbil Group is aiming for, and our vision, are clearly communicated to our customers. We will focus on corporate branding to ensure global understanding of azbil’s vision.

In this way, management and employees will work with integrity as a single team, partnering with our customers and society, to solve issues on site and create new value. By doing so, the azbil Group aims to contribute to the well-being of society and its employees, through business expansion based on contribution “in series” to the achievement of a sustainable society. We will fulfill the expectations of each type of stakeholder. This can take various forms, including pursuing business growth at the same time as improving returns for the shareholders who support the azbil Group’s philosophy and businesses. We sincerely hope we can continue to count on your support for the azbil Group’s initiatives for many years to come.