Medium-term Plan

New Medium-term Plan (FY2025–2027) and Revised Long-term Targets

Based on its philosophy of “human-centered automation,” the azbil Group strives to contribute to a sustainable society through its business activities, ensuring its own medium- to long-term growth and seeking to continuously improve enterprise value.

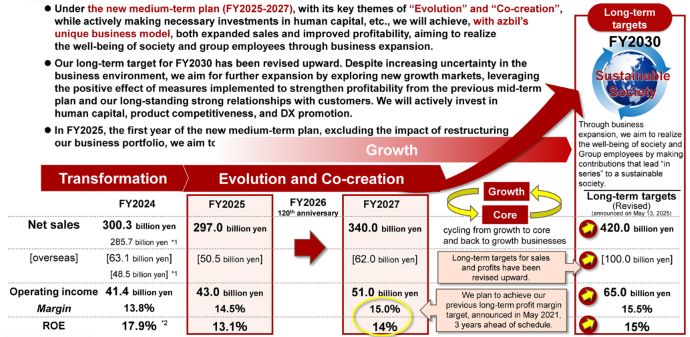

In May 2025, we announced our new medium-term plan (FY2025–2027) to realize further growth through expansion of our customer base in growth businesses while enhancing sustainability and profitability in core businesses. At the same time, we have also upwardly revised our long-term targets for FY2030.

In the new medium-term plan, leveraging our initiatives for “Transformation,” we aim to expand our business through “Evolution” and “Co-creation” while realizing the well-being of society and Group employees.

Growth in the azbil Group’s Unique Business Model

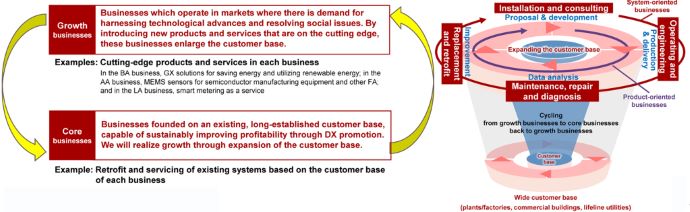

In our newly-announced medium-term plan, we have defined the expansion of our business through the following two core elements as the azbil Group’s unique business model: The first one is “growth in our core businesses” based on the strong relationships with our wide customer base (plants/factories, commercial buildings, and lifeline utilities), which the Group built over many years. The second is “establishment and expansion of growth businesses,” which harness new business opportunities that arise from technological advances such as semiconductors, as well as social issues including realization of carbon neutrality.

Specifically, we will expand our growth businesses by introducing new, cutting-edge products and services to markets, including semiconductors and data centers, where technological advances and action to address social issues are required. In overseas markets where we have achieved business growth thanks to progress with product/sales measures, we will promote locally led initiatives suited to regional characteristics over the next three years, aiming for further growth and expansion of our customer base.

In our core businesses, we provide value-added products and services that address new issues for customers with whom we have built long-standing relationships of trust. Through these efforts, we believe that we can continuously maintain and improve profitability.

In this way, we will achieve sustainable business expansion by cycling from growth businesses to core businesses back to growth businesses, where we will expand our customer base in growth businesses and enhance sustainability and profitability in core businesses.

Planning Aggressive Investment to Strengthen Our Business Model

In order to further strengthen the azbil Group’s unique business model and achieve sustainable growth, we will execute aggressive investments in the three years covered by our new medium-term plan.

First, to expand both growth and core businesses, we will focus on securing and developing essential human resources to execute business strategies. In particular, we will steadily promote business growth and expansion through the acquisition and development of human resources with solution proposal capabilities and those who can play an active role globally. In addition, as an investment in human capital, we will work to introduce various incentive plans to enhance employee ownership and engagement, thereby building a robust system in which employees and their company work together to achieve their goals.

Beyond this, we will further enhance our product competitiveness by deepening our unique measurement and control technologies and application technologies, which are areas of strength for us, with a view to developing a range of competitive products. Specifically, we will focus on the development of cloud and AI applications, MEMS*1 sensing technology, and actuator technology. Furthermore, we will create digital transformation products and services that meet customer needs, while simultaneously improving operational efficiency and profitability by internal digital transformation to accelerate digital transformation across the entire Group.

*1 MEMS: Abbreviation for microelectromechanical systems. Ultra-compact devices or systems, which integrate electrical circuits and mechanical components like sensors on a substrate.

Strengthening the Management Foundation to Achieve Sustainable Growth

The azbil Group is working to strengthen its management foundation, which underpins sustainable growth. Over the next three years, we will further strengthen our foundation by focusing on organizational restructuring, management conscious of cost of capital, practicing sustainability management, and strengthening corporate governance.

<Organizational Restructuring for Growth>

To enhance the execution of our growth strategies, we established a new Group Management Strategy Department in April 2025. In 2024, though we transferred Azbil Telstar, which had been part of our LA business, this department serves as the core of our ongoing work to optimize the Group's overall business portfolio. In addition, we plan to expand our local organizations to strengthen strategic planning and execution suited to regional characteristics in overseas markets.

<Promotion of Management Conscious of Cost of Capital>

We will further entrench return on invested capital (ROIC) as a criterion for management decision-making throughout the Group, promote management that emphasizes capital efficiency, and conduct business operation conscious of the cost of capital to prioritize resource allocation to future growth investments.

<Sustainability Management>

We will promote sustainability management throughout the Group based on our unique SDG goals and materiality. In addition to supporting the reduction of CO2 emissions at customer sites and working toward our own net-zero target certified by SBTi, we will strive to establish a sustainable business foundation through strengthening human capital investment, promoting diversity and inclusion, respecting human rights, and enhancing our risk management system.

<Strengthening Corporate Governance>

To enhance the independence and supervisory functions of the Board of Directors, we have established a structure with an outside director serving as chairperson, and where 70% of directors are outside directors and 30% are female directors. In addition, we improved our remuneration policy with a focus on transparency and accountability by expanding the performance-linked component of the remuneration structure for corporate executives, setting new incentive return on equity-linked key performance indicators for stock-based compensation, and introducing a clawback policy that allows for the return of compensation in the event of serious misconduct.