Environmental Social Governance (ESG)

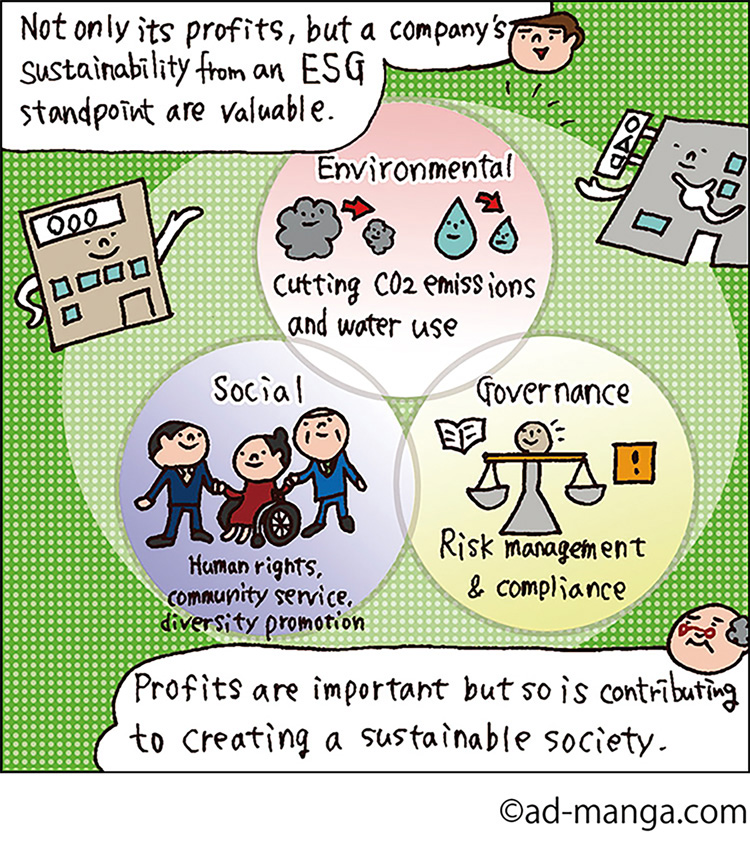

An abbreviation for the words environmental, social, and governance; the idea that these three viewpoints are necessary for the sustainable growth of society and of companies.

- Environment, society, and corporate governance receive worldwide attention

- Why is ESG attracting attention?

- What exactly is included in “ESG”?

- Along with actions, proactive information disclosure is important

Environment, society, and corporate governance receive worldwide attention

In April 2006, the then UN Secretary-General, Kofi Annan, announced an initiative. It was the promotion of Principles for Responsible Investment (PRI)-principles that incorporate environmental, social, and governance issues into the investment process. The background of this initiative was the pursuit of short-term profits and a tendency to put sales above all else. Mr. Annan argued that, in order to make effective long term investments, the financial industry should depend not only on quantitative assessments of financial information such as cash flow or profitability, but also on non financial information such as environmental, social, and governance matters.

Now, after more than 10 years have passed, ESG issues are increasingly attracting attention, and an emphasis on ESG has become a major trend among global investors. This can be inferred from the fact that, according to a survey,※ ESG-related investments in 2018 reached approximately $30.683 trillion.

Why is ESG attracting attention?

One viewpoint current in the capital markets is that it is indispensable for the pursuit of long-term investment returns to minimize the impact of environmental and social problems and create a sustainable society as a whole. In line with this perspective, ESG investment is based on the idea that recognizing the importance of environment, society, and corporate governance issues ultimately leads to the sustainable growth of companies and the expansion of medium to long-term profits, and also allows the discovery and removal of risk that is difficult to see in financial indexes. For example, consider a country’s pension fund that has a long-term time horizon and does not hold shares directly, but is a universal owner of a large amount of assets managed by external organizations. Multiple financial institutions holding the fund’s assets manage them as instructed by the pension fund. For this reason, if the fund places importance on ESG, companies whose management is actively ESG-conscious will be selected as investments, resulting in the sustainable growth of society as a whole, as well as long-term stable returns.

Nowadays in capital markets, ESG has become an important consideration for investment. Companies wishing to attract investment must actively address ESG issues in order to be positively evaluated in the market.

What exactly is included in “ESG?

What, then, are the specific elements of ESG?

Actually, there is no global standard for “ESG.” A number of ESG evaluation agencies have put out evaluation details based on their own standards. Here are some typical elements.

Environmental: Countering climate change (cutting back and reducing CO2 emissions, etc.), contributing to biodiversity, preserving water resources, etc. Social: Improving working conditions, respecting human rights (such as hiring without discrimination), community service, sincere and fair procurement, diversity promotion, etc. Corporate Governance: Transparent governance, risk management, etc.

Along with actions, proactive information disclosure is important

ESG might seem to be difficult, but many of the typical elements have already been worked on by many companies. For years, many companies have worked to reduce carbon dioxide (CO2) emissions and prevent environmental pollution, and are eager to contribute to the community.

However, even though they tackle these issues, companies will not be considered for ESG investment unless their activity is known to investors. In other words, information disclosure is very important.

ESG evaluation agencies evaluate companies based on the disclosed information. Companies must clearly disclose the details of their efforts, as well as their policy for the future and data that can be used for objective evaluation. For example, “We think water is precious” is not enough. It is important to disclose specific and objective information such as a goal of “reducing water usage by XX% by year XXXX,” or a report on tree planting activity for water resource conservation.

Since it has an impact on stock market valuations, we will be seeing more and more ESG information in the future.

※ Global Sustainable Investment Review 2018, published by the Global Sustainable Investment Alliance.