Azbil Publishes 2021 Integrated Report

- Explains Value Creation Based on Automation That Contributes “In Series” to the Achievement of a Sustainable Society -

TOKYO, October 26, 2021: Azbil Corporation (Tokyo Stock Exchange Code: 6845) announced that it has published the English version of its 2021 integrated report, “azbil report 2021.” The report narrates the azbil Group’s unique value creation that contributes “in series” to the achievement of a sustainable society through the Group’s automation technology, products, and services. The report comprehensively details management strategy and structure, business overview, management of various operating capital (financial, human, manufactured, etc.) supporting those units, risk management, and strengthened corporate governance responding to revisions of corporate governance codes.

azbil report 2021

The illustration represents contributing

"in series" to a sustainable society

through the new long-term targets

and medium-term plan

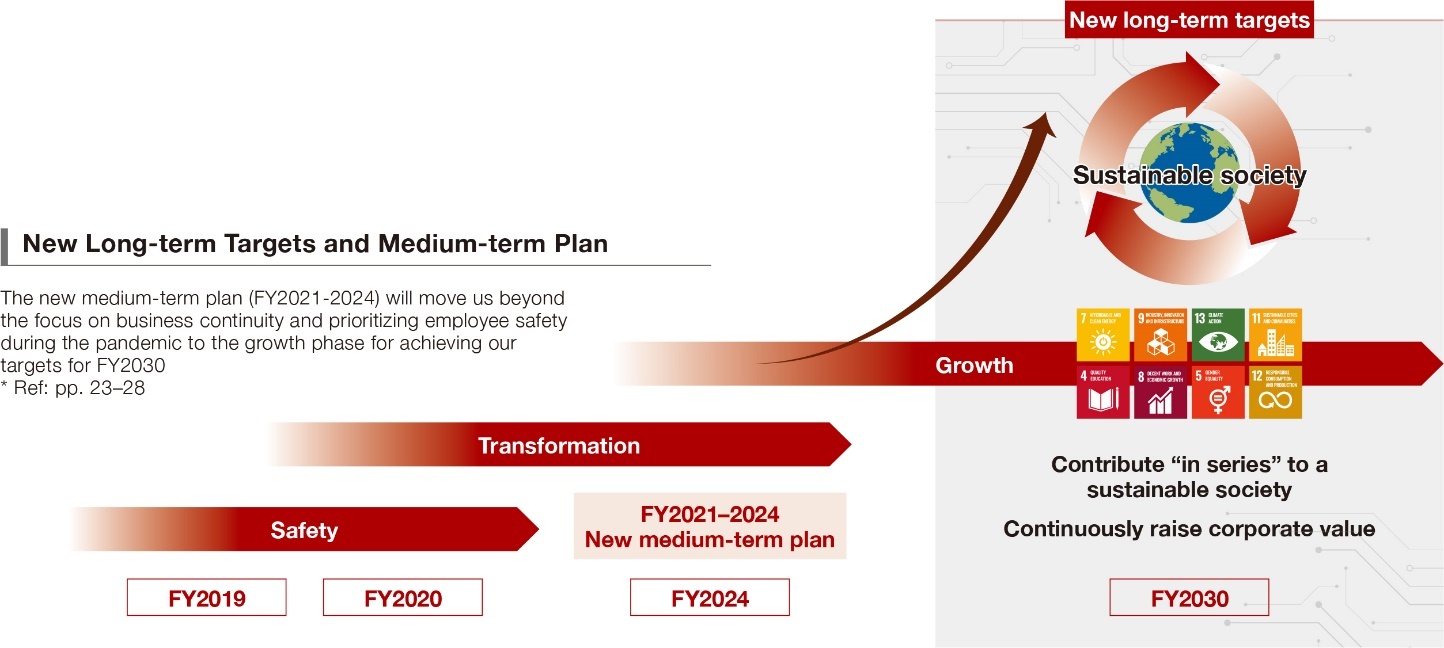

Based on the philosophy of “human-centered automation,” the azbil Group aims to contribute “in series” to the achievement of a sustainable society. In doing so, it strives to secure its own medium- to long-term growth and sustainably improve its corporate value. Explained also in the report is how the Group has set concrete measures to realize that growth, which include establishing new long-term targets (for fiscal year 2030) and a new medium-term plan (for fiscal years 2021 to 2024) focused on three growth fields?new automation, environment and energy, and life-cycle solutions?which share a common foundation of automation technology. In addition, the report covers ESG initiatives to be achieved for fiscal year 2030, namely the azbil Group’s own targets for the SDGs and attaining growth through the Group’s business and general corporate activities.

The integrated report can be downloaded from the following website.

azbil report 2021

* Please see “Reference Information” below for details on the aforementioned long-term targets, medium-term plan, targets for the SDGs, ESG initiatives, and contents of the integrated report.

Guided by the Group philosophy of "human-centered automation", the azbil Group will continue to realize safety, comfort, and fulfilment in people's lives and contribute to the global environmental preservation. Furthermore, the Group aims to resolve social issues and implement continual growth through management that contributes “in series” to the achievement of a sustainable society and the SDGs.

Reference Information

Select topics explained in azbil report 2021

1) New long-term targets and new medium-term plan

The new long-term targets, which are to be met by fiscal year 2030, are net sales in the 400 billion yen range, operating income in the 60 billion yen range, operating income margin of approx. 15%, and return on equity (ROE) of approx. 13.5%. As the first step to achieving those targets, the new medium-term plan (for fiscal years 2021 to 2024) focuses on the previously defined three growth fields, which share a common foundation of automation technology, and aims for global growth in the Group’s businesses of Building Automation (BA), Advanced Automation (AA), and Life Automation (LA) with net sales of 300 billion yen, operating income of 36 billion yen, operating income margin of 12%, and ROE of approx. 12%.

2) Practice of value creation: contributing to the SDGs

As society faces many issues to tackle, including climate change, the COVID-19 pandemic, significant changes to working and living environments, declining birthrate, aging population, and a changing societal structure, automation must respond to ever-growing social issues and business fields. The azbil Group’s business, which comprehensively provides automation technology, products, and services, itself can contribute “in series” to responding to these issues and fields and is linked to the achievement of the UN’s SDGs. The azbil Group has established its own essential goals for the SDGs*1, including achieving an effective CO2 reduction at customers’ sites of 3.4 million metric tons through the Group’s products and services, establishing the “2050 Long-term Vision for Reducing Greenhouse Gas Emissions,” which aims to reduce GHG emissions (scopes 1 and 2) *2 through business activities to substantially zero, and fulfilling our responsibilities to society across our supply chain.

3) Strengthening the foundation for value creation: ESG initiatives

The azbil Group engages in various initiatives that support business growth and strengthen the foundation for value creation that ensures sustainable growth (ESG initiatives). As an example that deals with the environment, the Group has priority measures for realizing integrated environmental corporate management*3 and disclosing the impact of climate change on business activities (opportunities, risks, etc.) as per TCFD recommendations. For social issues, initiatives focused on human resources are underway for respecting individuals’ rights, work-style reform, and promoting diversity & inclusion. Regarding governance issues, the azbil Group has established various initiatives including those that deal with risk management as well as strengthen corporate governance, including organizing the board of directors with a skills matrix-based focus, enhancing the corporate governance structure from supervision to execution, and ensuring transparency.

Contents and outline of azbil report 2021

| azbil’s Value Creation |

|---|

| Message from Management, History of Value Creation, Value Creation Model, 2020 Highlights, Financial and Non-Financial Highlights |

| The integrated report introduces the history of the azbil Group’s value creation through automation since the Group’s founding. The section about the value creation model covers the process starting from investing in operating capital to the value provided by the Group (outcomes), as well as business activity highlights over the past year based on the model. |

| Interview with the CEO |

| Interview with the CEO |

| Kiyohiro Yamamoto explains the new long-term targets and medium-term plan that aim for business expansion based on the three growth fields and the goals for the SDGs and ESG initiatives unique to the azbil Group, all of which contribute “in series” to the achievement of a sustainable society. |

| Establishing New Long-term Targets and the New Medium-term Plan |

| Results of the Previous Medium-term Plans, Outline of New Long-term Targets and the New Medium-term Plan, Initiatives to Realize the New Medium-term Plan (FY2021?2024), Message from the Executive Officer in Charge of Finance and Business Management |

| This section presents the previous medium-term plans, an overview of FY2020, an outline of the new long-term targets and new medium-term plan, and details on investments and initiatives to realize the new medium-term plan. The executive officer in charge of finance and business management explains management that takes into account capital costs, capital policies, and shareholder returns. |

| Practice of Value Creation?Provision of Value to our Customers |

| At a Glance, Building Automation Business, Advanced Automation Business, Life Automation Business, Global Network, Technological Research and Product Development, Manufacturing and Procurement, Sales, Engineering, Installation, and Service |

| Readers can find information on the azbil Group’s business segments and their measures for implementing the new medium-term plan based on the current environment and results. There are also details on the azbil Group’s value chain that support the three business units’ growth, which spans from the technological research and product development to manufacturing, procurement, sales, engineering, installation, and service. |

| Practice of Value Creation?Contributing to the SDGs |

| azbil Group’s Value Creation and Approach to Realizing the SDGs, Essential Goal I: Environment and Energy, Essential Goal II: New Automation, Essential Goal III: Supply Chain, Social Responsibility, Essential Goal IV: Health and Well-being Management, An Organization That Never Stops Learning |

| This section covers CO2 reduction at customers’ sites and GHG emissions reduction targets through business activities that were approved by the SBT initiative. Also covered are the goals for the SDGs to be achieved through the Group’s business and general corporate activities, as well as how climate change impacts Group management, as per TCFD recommendations. |

| Strengthening the Foundation for Value Creation?ESG Initiatives |

| CSR Management of the azbil Group, Environmental Initiatives, Quality Assurance and Safety, CSR Procurement, HR Initiatives: Achieving Human Capital Management, Intellectual Property Strategy and Brand Management, Compliance and Internal Control, Risk Management, Corporate Governance, Board of Directors, Executive Officers, and Audit & Supervisory Board Members, Communication with Stakeholders that Connects to Co-creating Value |

| 【An introduction of the azbil Group’s CSR management is introduced here. There is an explanation of the relationship between major ESG issues, the azbil Group’s main initiatives, and the SDGs. Readers can also find out about ESG initiatives based on a foundation of value creation that supports sustained growth and communication with stakeholders. |

| Financial and Non-Financial Data |

| 11-Year Key Financial and Non-Financial Figures, Consolidated Balance Sheet, Consolidated Statement of Income, Consolidated Statement of Comprehensive Income, Consolidated Statement of Changes in Equity, Consolidated Statement of Cash Flows, Notes to Consolidated Financial Statements, Independent Auditor's Report |

| This section contains tables outlining 11-year key financial and non-financial figures. |

| Corporate Data |

| azbil Group Company Data, Corporate Data/Stock Information |

| This section introduces the Group’s company data in Japan and overseas, corporate data and stock information. |

*1 The essential goals are defined as Environment and Energy; New Automation; Supply Chain, Social Responsibility; and Health and Well-being Management, An Organization That Never Stops Learning

*2 Scope 1: Direct GHG emissions from a business (from fuel burning, industrial processes, etc.)

Scope 2: Indirect GHG emissions from using electricity, heat, or steam provided by another business

*3 Integrated environmental corporate management refers to management that comprehensively incorporates a wide range of environmental activities including decarbonization, resource circulation, and biodiversity conservation into business operations.

* Posted information is accurate as of the date of announcement.

Contact

Contact

For media inquiries

Robert Jones / Mikako Takahashi

Public Relations Section, Azbil Corporation

Phone: +81-3-6810-1006 Email: publicity@azbil.com