Interview with the CEO

Kiyohiro Yamamoto

Director, Representative Corporate Executive, President & Group Chief Executive Officer

- Q1. How do you evaluate the company’s performance in FY2022, the second year of the medium-term plan?

- Q2. How will the company meet the growing demand for automation?

- Q3. What is the company doing to bring about a transformation?

- Q4. How will the company expand its products and solutions in the three growth fields?

- Q5. How will you bring about transformation related to human capital?

- Q6. What is the plan for expanding business overseas?

- Q7. What are you doing about the deteriorating performance of the LA business?

- Q8. What ESG initiatives is the company implementing?

- Q9. What message would you like to share with stakeholders?

Q1. How do you evaluate the company’s performance in FY2022, the second year of the medium-term plan?

A1. The diligent effort we put into overcoming difficulties, such as procuring parts, was a key factor that enabled us to post record profits. Our performance also demonstrates that the automation business has more growth potential.

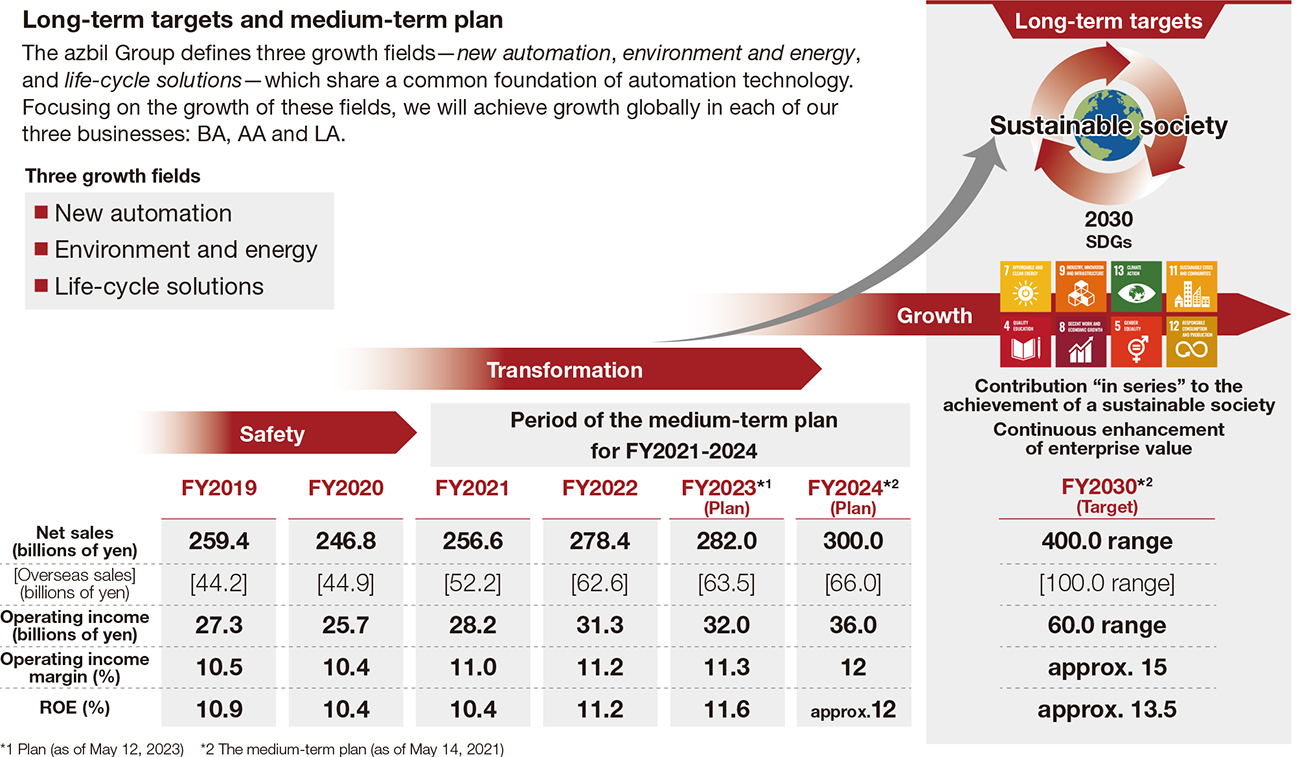

The azbil Group’s core automation business improves the quality of indoor spaces and productivity while also enabling control of the energy and resource consumption in buildings, factories, and lifeline utilities. Both of these contribute to the sustainability of society and the Earth, which means that expanding our Group business increases our contribution to achieving sustainability. Our medium-term plan for FY2021 to 2024 is the first step toward fulfilling our FY2030 target to be contributing “in series” to the achievement of a sustainable society. The plan also includes material issues that we must address to ensure our own long-term sustainability along with essential goals of the azbil Group for the SDGs to serve as key performance indicators (KPIs) for monitoring our progress.

During the first two years of the plan, the demand and expectations for automation have increased dramatically. Around the world, automation is increasingly being seen as a key component for achieving carbon neutrality to address climate change and for meeting the needs for safety and security and viable remote working environments that emerged during the COVID-19 pandemic. In addition to enabling the most efficient use of energy and resources, automation is also expected to save labor in areas where labor supply is diminishing.

FY2022 was certainly a challenging year for our business, as we had to deal with disruptions to global supply chains from the pandemic and geopolitical risk along with harsh economic conditions from soaring energy costs and inflation. Nevertheless, even in those conditions, demand for automation continued to steadily grow. We responded by radically overhauling our procurement and manufacturing processes, which enabled us to effectively overcome difficulties in procuring parts and to maintain our production activity. The Group also effectively passed on the higher costs to our product prices. These efforts paid off as the Building Automation (BA), Advanced Automation (AA), and Life Automation (LA) all increased orders and sales from the previous fiscal year and reached record highs.

Based on this performance and the future business outlook, management determined to boost shareholder return. Following our basic capital policy and in consideration of the need to retain funds to invest in R&D and human capital for our future growth, management resolved to distribute a year-end dividend of ¥33.50 per share, bringing the full-year dividend payment to ¥66 per share for FY2022, which is ¥1 higher than initially planned. Management also announced its intention to raise the ordinary dividend by ¥7 to ¥73 per share in FY2023. In addition, while following our disciplined capital policy, we plan to repurchase and cancel up to ¥10.0 billion worth (or a maximum of 4.0 million shares) of the company’s outstanding common stock.

Q2. How will the company meet the growing demand for automation?

A2. We will continue measures to bring about our transformation and ensure we fully meet the increasing demand for our future growth.

I believe that the steady progress in our business performance, the growing role that automation is playing in a sustainable society, and the uniqueness of the azbil Group’s technologies are all reasons to believe that we can continue growing our business.

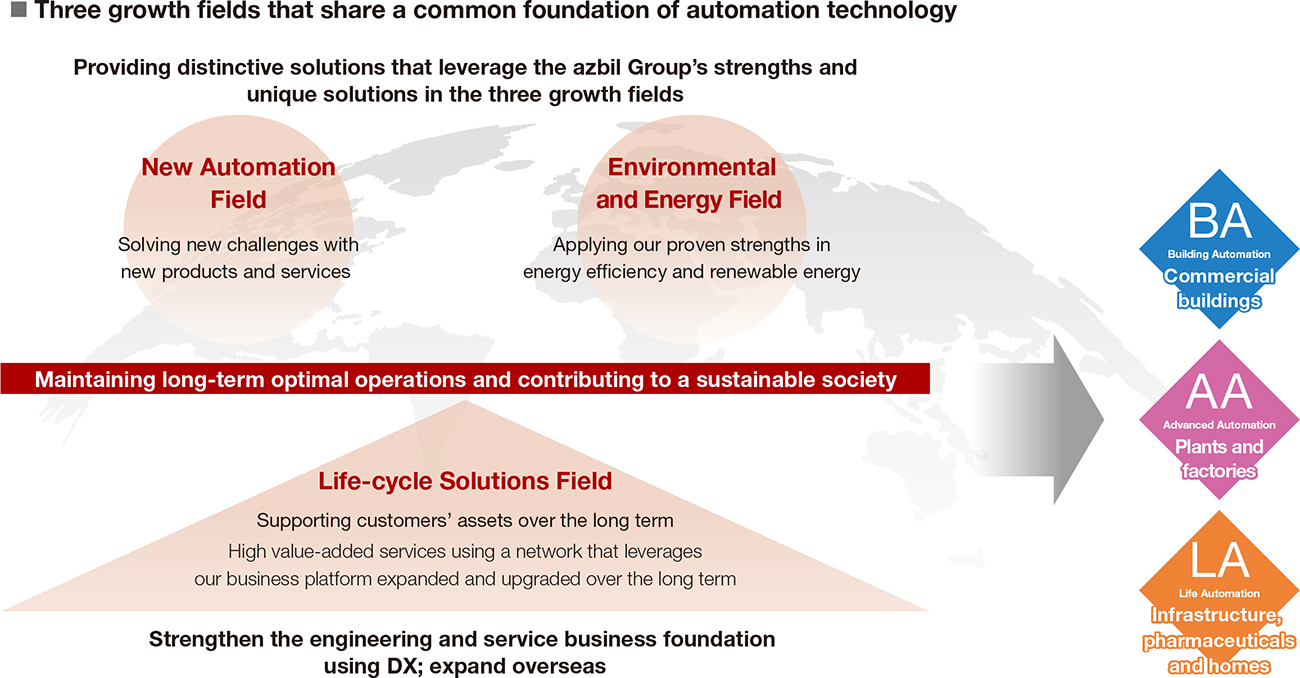

One of the major advantages of the Group’s automation business is the value we provide for automating air conditioning and production operations, improving the quality of indoor spaces and productivity, and controlling the consumption of resources and energy. On top of that, our automation provides those benefits throughout the complete building and factory life cycles from construction through operation, maintenance, and renovation. Recognizing the distinct areas where our automation systems provide value, we have set new automation, environment and energy, and life-cycle solutions as the three growth fields that the BA, AA, and LA businesses will pursue to bring about our transformation.

We also recognize that the needs of our clients are changing. They are responding to the pandemic, growing geopolitical risk, and climate change by restructuring their global supply chains, converting to new energy sources, and changing their business models at an unprecedented pace. The azbil Group’s automation business offers a wealth of technologies, products, and services for the new business models and a sustainable society. I believe we can continue augmenting our products and services and fortifying our business structure to offer value that clearly sets us apart from other companies.

As time goes on, business conditions will surely become more challenging and our clients will need increasingly sophisticated equipment. While working to establish sustainable growth for our business, I am renewing my commitment to accelerate our transformation and to steadily progress toward fulfilling the targets of the medium-term plan.

Q3. What is the company doing to bring about a transformation?

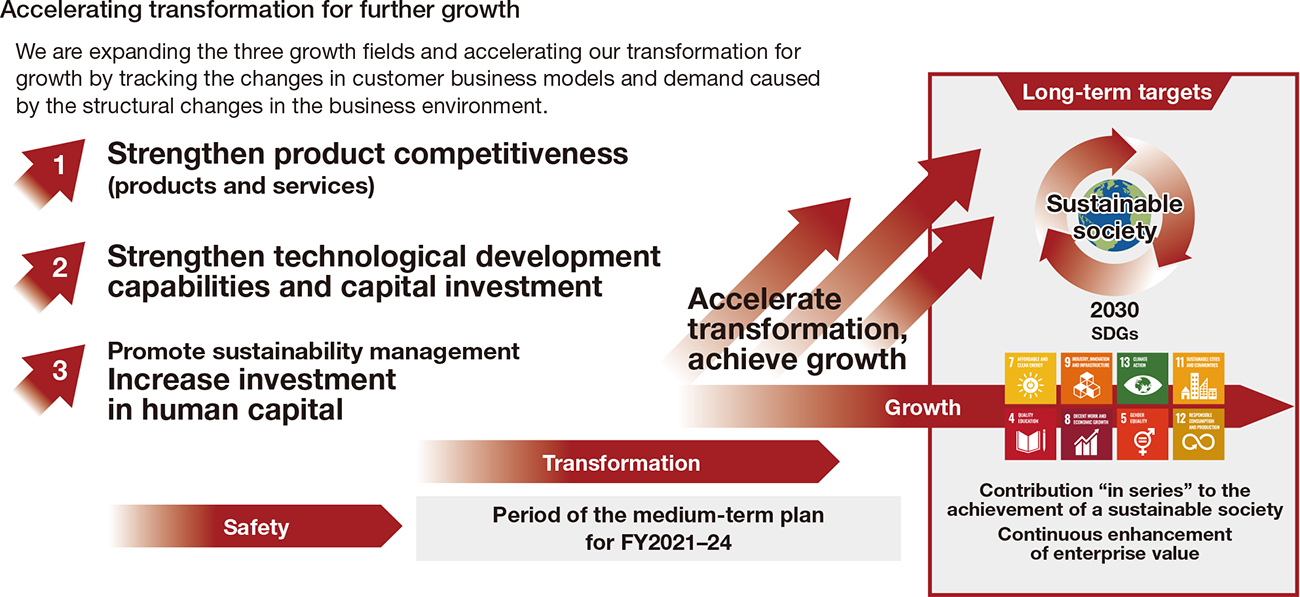

A3. While conducting sustainability management, we are actively advancing R&D, investing in our production facilities and product lines, and cultivating our human capital.

Business conditions are changing at an ever-faster pace. For us to continue growing our business, we must have a strong and resilient business structure capable not only of identifying and adapting to changing business conditions but also of providing innovative solutions to our clients and society. Our sustainability management gives us a strong footing, but we also must have the agility to respond to major unexpected developments, such as a pandemic, geopolitical risk, and disruptions in energy supply. In addition to our current strategies, we will also strengthen our ability to respond to risk and emergency situations and ensure we have the strongest possible business continuity plan. As we fortify our own resilience, we are also improving our ability to support client efforts to transform their business models. The cornerstones of our transformation and our future growth will be the strategic allocation of resources, particularly of personnel and financial resources, the enhancement of our product lines, and the development of the human capital that energizes our businesses. The ultimate objective of all of these is to expand our business both domestically and worldwide.

Fortifying our technology and product development capabilities led by the Fujisawa Technology Center

The fundamental framework for the growth initiatives in the three growth fields is for each core business to deploy its own business model centered on strengthening their technology development capabilities and boosting product competitiveness.

The state-of-the-art R&D and testing capabilities of our new laboratory facility constructed at the Fujisawa Technology Center in FY2022 enable development of advanced cloud and AI (including generative AI) system solutions and high-performance, high-precision devices and actuators using microelectromechanical systems (MEMS) technologies, which are the pivotal elements that enable our products to deliver value at our clients’ sites.

Also critical to our growth is the digital transformation (DX) of our internal processes. We are integrating digital technologies into every aspect of our operations from the development of products and services to processes that will improve the efficiency and enhance the value of our operations, which will create new business and new ways of working. We also see the promise of generative AI services, which could be huge for our operating efficiency. We are working toward integrating generative AI into our systems while preparing guidelines for its safe use and preparing the necessary support tools. The DX will encompass every aspect of our operations from R&D to product development, sales and services, engineering, maintenance, and operation, and we will actively invest in the human resources and equipment that will be needed. This transformation will give us the ability to develop more sophisticated and competitive products to drive our business growth into the future.

Strengthening our product lines in three growth fields

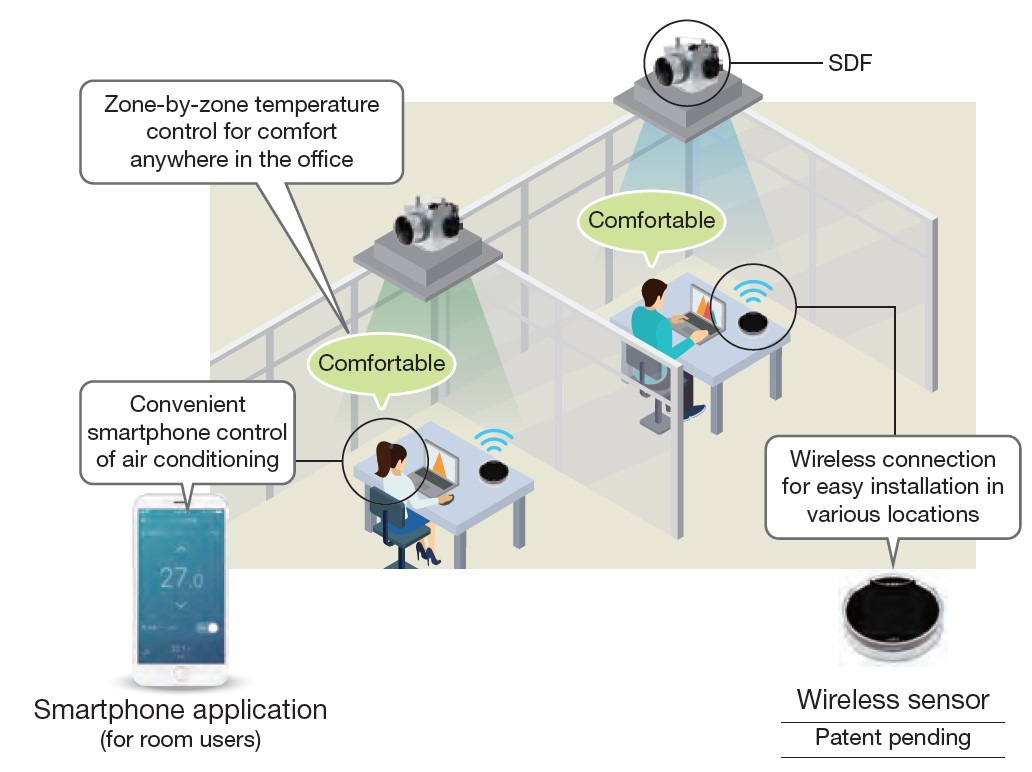

New automation field

Delivering new products applying advanced measurement, digitalization, and autonomy for solving issues

The new automation field provides solutions to demand arising from social issues and changes in client business models. A prime example of a product meeting new demand is our sapphire capacitance diaphragm gauges. The gauges incorporate MEMS technology to dramatically enhance the productivity of film formation and etching processes for semiconductor manufacturing equipment. Other examples are our new line of cell-type air conditioning systems that improve comfort as well as support wellness in office spaces, and the automated AI systems for factories and plants that perform various processes and free workers to focus on tasks that benefit from human skill and creativity.

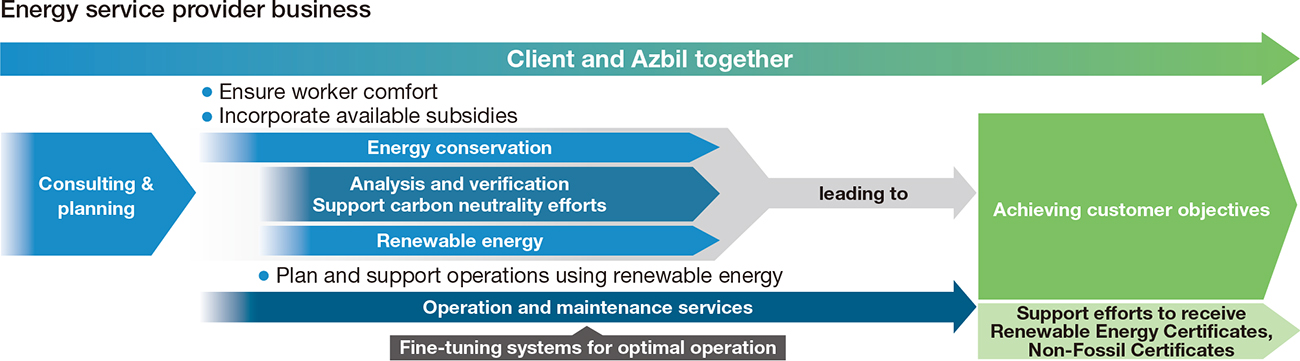

Environment and energy field

New businesses for green transformation (GX)

As the drive to achieve a carbon neutral society gains momentum, our clients are increasingly investing to reduce their carbon footprint. We are meeting that demand by augmenting our most competitive products and services and by working with outside partners to develop new value and expand the scope of solutions we offer. The BA business is currently focusing on providing solutions for its extensive portfolio of existing clients, from which we expect equipment retrofit demand as their facilities reach the refurbishment stage of their life cycles. We are also collaborating with partner companies to develop equipment for GX to be an energy service provider offering systems that run on renewable energy sources. We provide value by offering comprehensive energy solutions customized to each client’s individual specifications in all aspects from arranging renewable energy supply sources to ensuring optimized systems management.

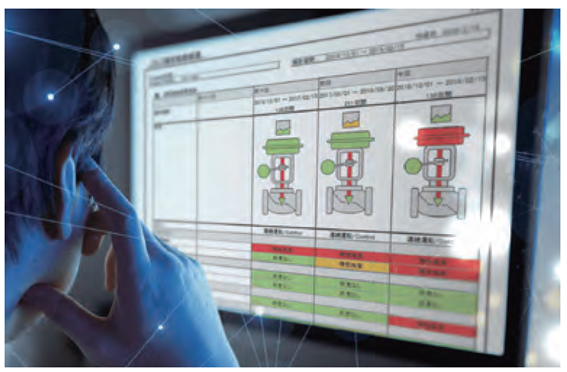

Life-cycle solutions field

DX to maintain and improve client asset value

The life-cycle solutions field provides high value-added services for maintaining consistent quality, operating performance, and productivity of factories, office buildings, lifelines utilities, and other assets. Clients are requiring increasingly higher value-added services, and we will need to deftly integrate cloud and digital technologies into our services to continue providing the system efficiency and value they need. We have been integrating cloud technologies to all of our businesses and have introduced several new products, such as the BA business’s building management system with remote monitoring and the AA business’s cloud-based valve analysis and diagnosis service. The Group infrastructure we introduced in April 2023 for fully integrated cloud services will provide a solid foundation for developing and offering additional cloud businesses in the future.

Q4. How will the company expand its products and solutions in the three growth fields?

A4. Co-creation with external partners will be a key way we will broaden our product spectrum.

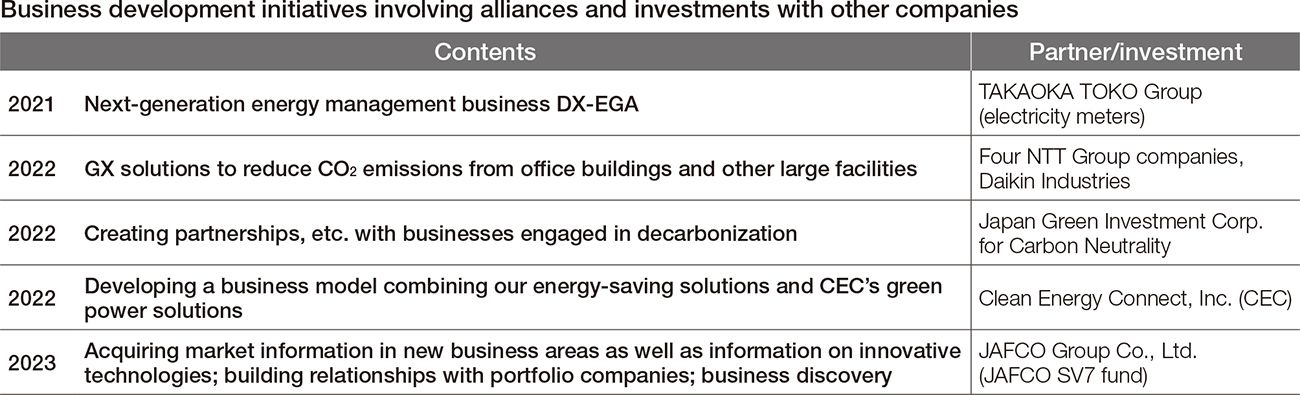

We will need to continue developing our products and services to keep pace with the increasingly varied and sophisticated needs of our clients. One way we will keep pace is by participating in more co-creation activities with external partners, such through collaborations and capital participation with startups with compelling technologies and industry, government, and academia groups.

In FY2022, we invested in the Japan Green Investment Corporation for Carbon Neutrality (JICN), a public?private fund newly established by the Ministry of the Environment, with the aim of creating new business opportunities in decarbonization and joining in decarbonization partnerships in fields that have been outside our reach. Our recent capital and business alliance with Clean Energy Connect Inc. (CEC) combining the company’s green power solutions with our energy-saving solutions has created a one-stop GX service that is making a significant contribution to GX and a decarbonized society. In FY2023 we signed a memorandum with the Indian Institute of Technology Roorkee to collaborate in research for innovative digital solutions. Partnerships such as these are a way that we can multiply the benefits of our technologies and products, and we will continue collaborating with partners to pursue new ways to address environmental issues and extend the positive impact of our products and services.

Q5. How will you bring about transformation related to human capital?

A5. We are increasing investment in our human capital and expanding the DX education program.

Fulfilling our mission to be contributing “in series” to a sustainable society will require steadily developing the human resources that are the source of value creation and forming a carefully mapped out plan for resource allocation that looks five and ten years in the future.

The azbil Group’s basic principles of human resource development has fostered a culture in which we view our people as having multiple assets, or capabilities, that they would develop and cultivate on their own in accordance with changing needs. This approach to developing human resources therefore relied on both on- and off-the-job training, or what is now called reskilling. We are currently revising and updating our personnel systems by building on the successful elements of that approach and integrating new features, such as incentive plans linked to financial measures. After implementing the revisions, we will continue improving the systems by closely monitoring outcomes with the essential SDG goals we have set for employee satisfaction and sense of growth through their jobs.

We are also increasing investment in the human capital needed to advance our business strategies in the three growth fields. This encompasses carefully organizing our human resources, using our talent management system and learning management system to optimally train and allocate engineers, recruiting specialist personnel, engaging in joint research and development with universities and research institutes, and dispatching employees to R&D partners.

Q6. What is the plan for expanding business overseas?

A6. We are strengthening our overseas sales and service networks and developing distinctive products and services tailored to each region.

The growth of the azbil Group will largely depend on increasing our business overseas. Our plan is to expand our customer reach by fortifying our sales structures in strategic regions and by using DX to enhance the effectiveness of our sales activities. We are also strengthening our ability to develop and offer high value-added products and solutions catered to the market specifics in each country and region. One example of that is the digital twin product we developed for an integrated building management system (IBMS) with the support of the Singapore Economic Development Board. We established the Strategic Planning & Development Office for Southeast Asia in Singapore to provide cross-organization support for business promotion, strategic plans, and management of subsidiaries in the region. The office also serves as a central link for promoting collaborative technology development in the three regions of Japan, the Americas, and Asia.

Q7. What are you doing about the deteriorating performance of the LA business?

A7. We are reviewing the business to optimize the business portfolio.

The LA business posted a profit decline in FY2022 and earnings ended up substantially below expectations. Various factors were involved, but the biggest impact came from the rapid inflation in Europe, which increased our costs and caused a profit drop in the Life Science Engineering(LSE) field. We have closely examined each LA business operation for the causes and issues that contributed to the weaker earnings and plan to directly address each point. This year, we are reviewing and optimizing the business portfolio and adjusting individual business strategies. In addition, we are taking steps to pass on the higher costs to our product prices, improve quality control, and strengthen project management.

Q8. What ESG initiatives is the company implementing?

A8. Our sustainability management includes actively engaging in ESG activities with an awareness of materiality for both growth opportunities and management risks.

In August 2022, we identified 10 material issues that we must tackle over the long term to ensure the azbil Group’s sustainability management and activities to contribute “in series” to a sustainable society remain relevant and effective. The issues of materiality reflect the significant changes in the social environment and in societal needs. The issues of materiality also provide us with perspective on the opportunity and risk for the Group’s philosophy in the changing business environment. We will proactively address the issues of materiality in each area of the environment, society, and governance.

I also believe that a fundamental part of our ESG initiatives must focus on protecting our business continuity, and we should be fully prepared for any risk that could arise to threaten our sustainability. A global corporation is especially obligated to ensure its business complies with all legal regulations and respects human rights. As our business grows and we extend our supply chain into more countries and regions, we will need to strengthen our efforts for human rights due diligence. Moreover, full cooperation throughout the supply chain will be critical to ensuring we are resilient to disruptions in the supply chain as occurred during the pandemic and due to geopolitical risk. We continue to examine and prioritize the material risks to the azbil Group to ensure our management system remains robust and resilient.

Taking a medium- to long-term perspective for strengthening our ESG measures, applying a defensive approach, and being fully prepared for risk can open the door for the Group to find new business opportunities. I believe that when we are recognized as a corporate entity that values non-financial elements such as human rights, diversity, and its relations with stakeholders, we will attract business opportunities and talent both in Japan and overseas, which will lead to growing business and ultimately manifest in financial value.

Environment

The azbil Group’s identity became strongly linked to environmental action in the 1970s when it introduced the concept of “Savemation” (Save + Automation). Our current environmental efforts are primarily focused on reducing greenhouse gas emissions from our activities (scopes 1+ 2) and from our supply chain (scope 3). We have also positioned the environment and energy business as a growth field for our business where we will offer products and services to reduce the environmental impact of our clients. To spur our efforts, we have set our own essential SDG goal for reducing CO2 emissions from our clients’ sites.

We also see potential to meaningfully address environmental issues in other ways and have strengthened and expanded our initiatives to address various environmental issues in addition to reducing CO2 emissions. As part of this, we have set specific recycling and sustainability design targets. New products are designed for recycling to ensure natural resources are used efficiently and waste generation is minimized, and for sustainability to ensure our products and services are environmentally friendly. In addition, we have endorsed the international Task Force on Climate-related Financial Disclosures (TCFD) framework and actively disclose information on governance, strategy, risk management, and metrics and targets in our Securities Report.

Society

We endorsed the United Nations Global Compact on human rights, labor, the environment, and anti-corruption and our medium-term plan includes stronger initiatives related to human capital and intellectual property. Our health and well-being management encompasses a variety of initiatives and programs designed to encourage employees to engage with their work actively and enthusiastically. We intend to make diversity a strength of the Group and have formally declared our commitment to diversity and inclusion with goals to hire international and mid-career talent. We also implement measures to ensure our supply chain complies with the expectations of society. We apply the azbil Group Basic Policy on Procurement and the azbil Group CSR Procurement Guidelines to our supply chain, and we hold information briefings and actively engage in dialogue with all business partners. We are also encouraging our suppliers to strengthen their human rights due diligence and reduce CO2 emissions.

Governance

In June 2022, Azbil Corporation transitioned to a company with a three-committee Board structure for the purpose of clearly separating supervisory and business execution functions and to increase the speed and transparency of our decision-making processes. To further enhance the Board of Directors effectiveness, we created a system of the Liaison Meeting for Directors and Corporate Executives for more active and frequent discussion about important issues such as the identification and disclosure of materiality, disclosure of numerical figures for climate change risk and profit opportunities, and the formulation and disclosure of basic policies for the Group. We also revised our officer remuneration system by initiating a stock-based remuneration plan and disclosing the remuneration policy.

I believe that the growth of the azbil Group and the strengthening of corporate governance are two sides of the same coin, and it is in our best interests to continuously seek to improve and fortify our governance. In the year ahead, we will further improve the quality of discussions at Board of Directors meetings and continue our efforts to enhance our enterprise value and share that value with shareholders and stakeholders.

Q9. What message would you like to share with stakeholders?

A9. We believe that transforming our company is an urgent matter and the decisions we make now will be critical both to the Group’s growth and to the realization of a sustainable society.

To ensure the sustainability of our planet and the ongoing growth of the azbil Group and all of our shareholders and stakeholders, the Group must quickly transform and evolve in new directions. We are working toward the long-term targets we set for FY2030. We fully recognize, however, that it is the management decisions we make now and the actions of our group companies now, not years in the future, that will accelerate our transformation and lead to our growth into the long term. We appreciate the support of all of our shareholders as the azbil Group applies our philosophy of “human-centered automation” and seeks to contribute “in series” to the achievement of a sustainable society.