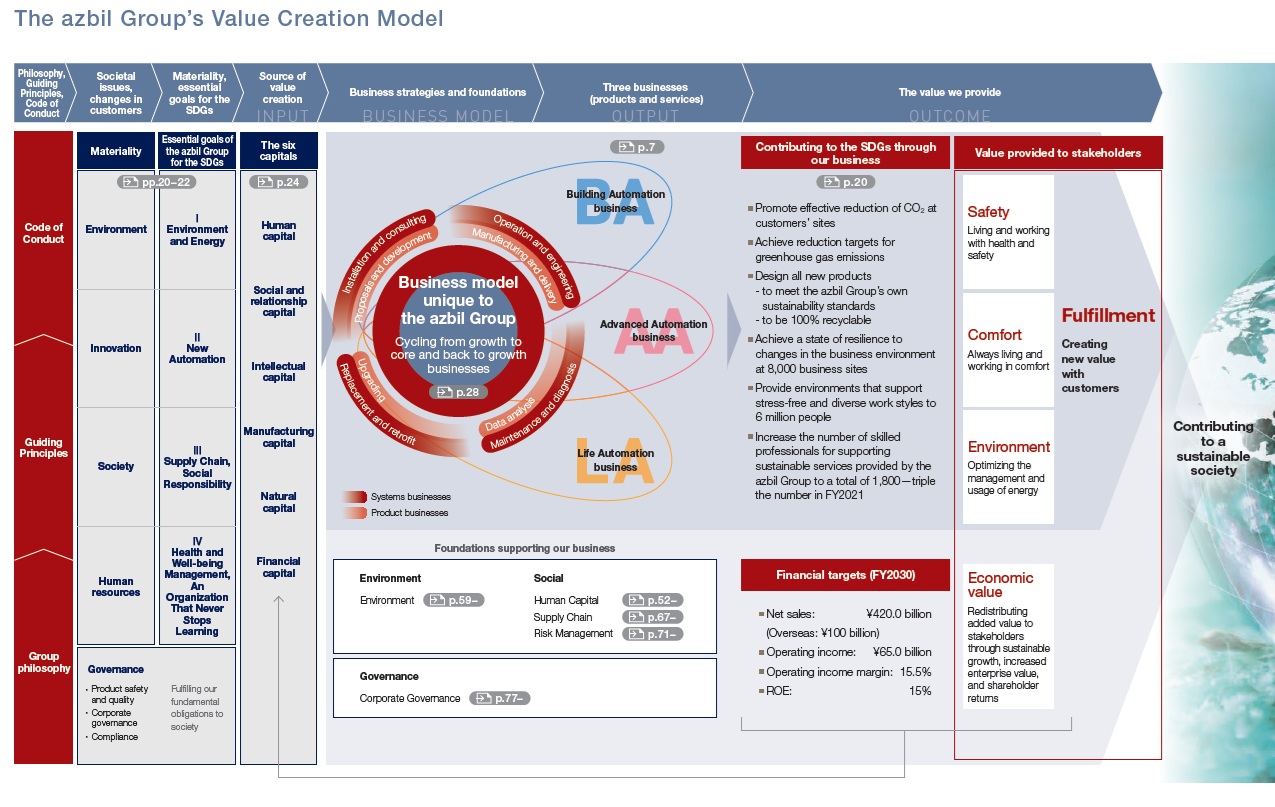

Value Creation Model

To address the changing issues faced by our customers and society, we have refined our technologies and solutions by applying our measurement and control automation expertise together with the idea of constantly solving problems while keeping the focus on people.

The azbil Group is unique in its ability to create value with our customers by working closely with them at their sites using its integrated system.

The azbil Group deliveri products and services and works with its customers to solve issues, thereby making contributes "in series" to a sustainable society, while also achievig sustainable growth for our business and increased enterprise value.

Click here for more information about "The azbil Group's Value Creation Model" and "The Six Capitals."

- References

- Medium-term Plan

- Environment

- Social

- Governance

The Six Capitals: The azbil Group’s Operational Resources and Source of Value Creation

The azbil Group leverages the capital accumulated over many years since its founding as an invaluable asset with which to develop its unique business model.

By strengthening these six types of capital, we will create more value and expand our businesses, through which we aim to contribute "in series" to a sustainable society.

| Six Capitals | Operational Resources and Source of Value Creation | |||

|---|---|---|---|---|

| Human capital |

Assisting growth and creating value via diverse human resources |

Number of employees (consolidated) | 8,922 | (as of March 31, 2025) |

| Azbil Academy attendees | 189,000 | (total for FY 2024) | ||

| Individuals who earned official qualifications |

2,764 | (total as of March 31, 2025) | ||

| Social and relationship capital |

Creating value through relationships of trust and cooperation with various stakeholders |

Sales and service bases in |

15 countries and regions | (as of March 31, 2025) |

| 13 companies in Japan | ||||

| 27 companies overseas | ||||

| Intellectual capital |

Strengthening our ability to produce products and services that address the issues facing society and our customers |

R&D expenses: | ¥49.5 billion | (FY2021–FY2024 results) |

| Capital investment to strengthen R&D site functions: |

Construction expenses: ¥7.1 billion |

(FY2021–FY2022 results) | ||

| Patents: | 2,254 | (as of March 31, 2025) | ||

| Manufacturing capital |

Sharing advanced production technologies throughout the Group globally |

Factories: | 10 in Japan | (as of March 31, 2025) |

| 4 overseas | ||||

| Natural capital |

Reducing our own environmental impact and assisting in efforts to reduce the environmental impact at customer sites |

Total energy use | 65,026MWh | (FY2024 results) |

| Total water use | 121 million L | |||

| Financial capital |

Allocating resources with a focus on ensuring capital efficiency and maintaining a sound financial base |

Total assets | ¥315.1 billion | (as of March 31, 2025) |

| Credit rating: | A+ | (as of October 21, 2024) (from R&I, Rating and Investment Information, Inc.) |

||