Materiality

Materiality identification process

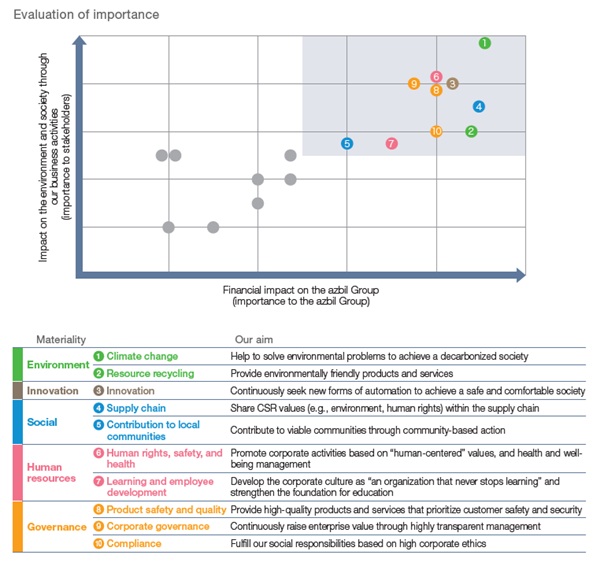

Environmental, social, and business structural changes—resulting from such factors as the need for action on climate change and the SDGs, as well as the declining birth rate, the aging population, and changes in the way people work—have led to the emergence of various new issues that need to be addressed. At the same time, automation—which can serve in a variety of ways, such as mechanization, labor saving, energy saving, and resource conservation— is playing an increasingly essential role in solving these challenges, further enhancing its value and the expectations placed upon it. Amid these changes, in August 2022, to achieve sustainable growth for the azbil Group, we incorporated double materiality (a concept that evaluates materiality from two aspects: financial evaluation of the impact of the environment and society on the company, and the impact of corporate activities on the environment and society) from the perspective of both opportunity and risk, based on the azbil Group philosophy. We have identified 10 material issues across five areas to be tackled over the long term. In FY2023, with advice from external experts, the following process for identifying materiality was reassessed, and its validity was reaffirmed. The materiality identification process for the azbil Group can be broadly divided into three steps.

The diagram on the right side of the page shows materiality and our aim, based on each materiality identified from issues of particular importance to the azbil Group and/or stakeholders, as well as the azbil Group’s initiatives. Among those items not included in the 10 material issues mentioned above, natural capital (e.g., biodiversity, water resources) is of relatively high priority.

Going forward, we will further assess and validate our approach in light of changes in the environment, society, and business structures, as well as their financial impact. To appropriately understand the effects and dependencies, as well as business risks and opportunities associated with natural capital, we are advancing nature-positive initiatives aligned with the recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD). In August 2024, Azbil registered as a TNFD Adopter and declared our commitment to report on the results of our initiatives in FY2025 in accordance with the disclosure recommendations.

STEP1 Understanding and identifying issues

Based on various guidelines (e.g., SDGs, GRI Standards, SASB Standards), social issues were comprehensively identified as materiality candidates.

STEP2 Prioritizing issues

For the materiality candidates, we identified opportunities and risks from the perspective of double materiality and

evaluated their level of importance, taking into account several key issues that emerged through stakeholder

engagement and advice from external experts.

Across five areas, we have identified materiality as 10 material issues of particular importance to the azbil Group

and/or stakeholders.

STEP3 Confirming appropriateness

Following conferral with external experts, the Management Meeting and Board of Directors confirmed the validity of the 10 material issues and reaffirmed the azbil Group’s materiality in FY2023.

Materiality and Essential Goals of azbil Group for SDGs

Based on the identified materiality, we have formulated specific targets for FY2030 for seven material issues, related to our business and general corporate activities, within the domain of the SDGs as the essential goals of the azbil Group for the SDGs. For the other three material issues, which are fundamental obligations that a company must fulfill to be a member of society, we have established specific goals as part of our CSR activities. We are promoting sustainability management through various initiatives to achieve these goals.

Click here for more information about Essential Goals of azbil Group for SDGs.