Disclosure aligned with the TCFD and TNFD recommendations

The World Meteorological Organization has announced that the global average temperature in 2024 was 1.55°C (±0.12°C) higher than pre-industrial levels (average temperatures from 1850 to 1900). Rising average temperatures are expected to lead to increased frequency and intensity of extreme heat, marine heatwaves, and heavy rainfall, and there are concerns that the resulting damage from floods, droughts, and storms will become even more severe. It can be said that humanity is facing an unprecedented environmental crisis.

According to the Global Assessment Report on Biodiversity and Ecosystem Services published by the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) in 2019, approximately 75% of the world's land has been significantly altered, and 66% of the ocean has been subjected to multiple human impacts. It has also been reported that the natural environment of the entire planet is changing at a rate never seen before in human history, with over 85% of wetlands having disappeared since 1700.

Additionally, global trends such as the adoption of the SDGs, decarbonization across society, and the movement toward nature positivity are expected to have an impact on companies in the form of stricter environmental regulations, changes in market demands for products, and increased demands on suppliers.

At the same time, we believe that the diverse functions of automation, which also include labor-saving, energy-saving, and resource-saving, play a major role in resolving these issues, further increasing the value and expectations of automation.

Given this background, the azbil Group views addressing social issues such as carbon neutrality as a new business opportunity, and has established a policy of expanding this business as a growth business in its medium-term plan.

Approach to disclosure

Materiality

To achieve sustainability management, we incorporated double materiality (a concept that evaluates materiality from two aspects: the financial evaluation of the impact of the environment and society on a company, and the impact of corporate activities on the environment and society) from the perspectives of both opportunity and risk, based on the azbil Group philosophy. In August 2022, we identified 10 materiality issues across five areas to be tackled over the long term. Subsequently, following discussions and confirmation with external experts in fiscal year 2023, the appropriateness of the plan was reconfirmed at the management meeting and Board of Directors meetings.

The azbil Group has identified climate change as one of its material issues. The azbil Group supports the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), which call for accurate understanding of the impact of climate change on business activities and appropriate disclosure. Although natural capital (biodiversity, water resources, etc.) was not included in the materiality list, it has been evaluated as an item of relatively high importance. Going forward, we will continue to consider changes in the environment, society, and business structure, as well as their financial impact, and will continue to verify the assessment of materiality identification further. We will promote nature-positive initiatives in line with the recommendations of the Task Force on Nature-related Financial Disclosures (TNFD) in order to properly understand our impacts and dependencies on natural capital, as well as our business opportunities and risks.

Scope of disclosure 【TCFD/TNFD】

We have organized the opportunities and risks related to climate change and natural capital by business type: Building Automation (BA), Advanced Automation (AA), and Life Automation (LA). We analyzed opportunities and risks in line with the TCFD's recommended approach for climate change and the TNFD's recommended approach for natural capital.

Regions with nature-related issues 【TNFD】

In accordance with the assessment methodology recommended by the TNFD, we traced our upstream and direct operations (azbil Group business activities) back to our suppliers' manufacturing sites and identified priority sites based on the importance of their business and the ecological sensitivity of their locations. Additionally, downstream, we are assessing the collection and disposal processes for azbil Group products on a country-by-country basis. Details of the assessment results are provided in “TNFD - Approach to Derivation of Opportunities and Risks” in the “Strategy” section.

Period under review 【TCFD/TNFD】

The TCFD's analysis period is set to 2030. The period covered by the analysis was chosen because the company is actively working toward the SDGs, which were adopted at the 2015 United Nations Summit and have a deadline of 2030, the guidelines issued by the Ministry of the Environment cite 2030 as an example of the timeframe for scenario analysis, and the azbil Group's long-term goals of the management plan are set for fiscal 2030.

The TNFD also set the target period as 2030, in line with the azbil Group's long-term goals and from the perspective of realizing the SDGs and nature positive.

Governance

Role of the Board of Directors

The azbil Group continues its sustainability management in its new medium-term plan starting in FY2025. The Management Meeting deliberates on climate change and natural capital from the perspective of disclosing business impacts and financial impacts, while the Board of Directors appropriately oversees these matters.

Stakeholder engagement

The azbil Group will build relationships of trust with stakeholders, including local communities and indigenous peoples, in addressing nature-related challenges, and fulfill its responsibility to respect human rights. We have established a system covering all stages from receiving inquiries and reports based on the azbil Group Basic Policy on Human Rights, through to investigation and verification, relief, and corrective and improvement actions.

Consultation and reporting on human rights issues, laws, and ethics violations

Strategy

Opportunities and risks were analyzed in line with the TCFD’s recommended approach for climate change and the TNFD’s recommended approach for natural capital.

A detailed analysis is shown in the chart below.

| Type | Climate change | Natural capital | Business | Details ( ) indicates climate change scenarios |

|---|---|---|---|---|

| Opportunities | ● | BA business | Growing demand for energy-saving and CO2-reducing solutions and services that meet societal needs (1.5°C/2°C scenarios) | |

| Increasing demand for products, services, and solutions for climate-resilient buildings adapted to weather disasters (4°C scenario) | ||||

| AA business | Increasing demand for sensors, various other measuring instruments, and solutions designed for new industries and processes that reduce environmental impact (1.5°C/2°C scenarios) | |||

| Increasing demand for products, services, and solutions that offer anomaly prediction capabilities (4°C scenario) | ||||

| LA business | Expanding smart metering as a service business for gas meters that use IoT technology (1.5°C/2°C scenarios) | |||

| Increasing demand for products, services, and solutions adapted to weather disasters (4°C scenario) | ||||

| ● | Group-wide | Increasing demand for solutions that meet the needs of markets dependent on natural capital | ||

| Increasing demand for sensors, various measuring instruments, and solutions due to tighter environmental regulations on wastewater, chemicals, etc. | ||||

| Increasing demand for new solutions utilizing IoT technology such as ecosystem monitoring | ||||

| Migration risks | ● | ● | Group-wide | Increased R&D costs for new products and services to meet new regulations |

| Increased production and procurement costs due to rising energy and raw material prices | ||||

| Reduced conventional capital investment from customers due to the burden from carbon taxes, biodiversity conservation, and other associated costs | ||||

| Physical risks | ● | ● | Group-wide | Operational stoppages and inability to provide products, services, and solutions due to abnormal weather (floods, droughts, rising temperatures, etc.) |

| Significant reduction in customer investment due to business instability caused by abnormal weather (floods, droughts, rising temperatures, etc.) |

TCFD

Climate change scenario analysis

Based on information from the Intergovernmental Panel on Climate Change (IPCC), the International Energy Agency (IEA), and other organizations, we have identified the long-term business risks and opportunities for the azbil Group until 2030 according to the 1.5°C/2°C scenarios*1 and the 4°C scenario*2. We understand the 1.5°C scenario to have the same opportunity and risk trends as the 2°C scenario, but with a greater degree of impact.

We considered both the opportunities and risks in each of our businesses based on rising temperature scenarios and have concluded that the opportunities for our businesses to contribute to CO2 reduction significantly outweigh the risks.

*1 These scenarios assume that temperature rises are contained within a sustainable range due to the implementation of stricter regulations and the introduction of technological innovations aimed at a decarbonized society.

*2 This scenario assumes that no effective measures to reduce GHG emissions are implemented, the temperature continues to rise, and extreme weather and natural disasters increase.

We divided risks into physical and migration risks and analyzed their financial impact. Although physical risks were estimated based on several assumptions, we believe that their impact on business will be limited due to the countermeasures we have in place, such as decentralizing our production network and formulating business continuity plans.In addition, regarding migration risks, we are implementing systematic risk mitigation measures concerning our own GHG emissions. Emissions from the azbil Group’s business activities (scope 1+2) were approximately 0.012 million metric tons of CO2. Even if carbon prices rose by ¥10,000 to ¥20,000 per ton, the total financial burden would be limited to around ¥100 million–¥200 million. However, after quantitative evaluations of the impact on the azbil Group’s business in 2030 in the hypothetical 1.5°C/2°C scenarios, we expect it to lead to an effective reduction of CO2 at customers’ sites and the expansion of new energy markets. We therefore estimate this will contribute to an increase in sales of at least ¥12 billion per year.

Building Automation business: approx. ¥7 billion

With the growing adoption of renewable energy sources and rising electricity rates, we anticipate heightened demand for our existing energy conservation services, including our total energy management service (TEMS), driven by the increased installation of related and high-efficiency equipment. We also expect an expansion in business opportunities for one-stop services that combine energy procurement and emissions trading (such as from renewable energy sources) with an energy management system (EMS) that centrally manages everything from the visualization of CO2 emissions to carbon offsets. Our estimates are based on scenarios with certain assumptions, historical installation data, and customer needs in the hospital and hotel markets, where energy use is high.

Advanced Automation business: approx. ¥5 billion

We anticipate an increase in business opportunities in markets that contribute to carbon neutrality (hydrogen, CO2- free ammonia, carbon recycling/CCUS*3). Our estimates are based on scenarios with certain assumptions arising from current trends, past installations in the target market, and the target market’s growth rate according to third-party research organizations.

*3 CCUS:Carbon dioxide Capture, Utilization and Storage

Decarbonization transition plan

In response to the movement toward decarbonization across society as a whole, we are working to help solve energy-related issues for our customers and society, and are formulating and implementing transition plans toward decarbonization.

Decarbonization transition plan

TNFD –Derivation approach for natural capital risks and opportunities

Location of priority sites

Upstream

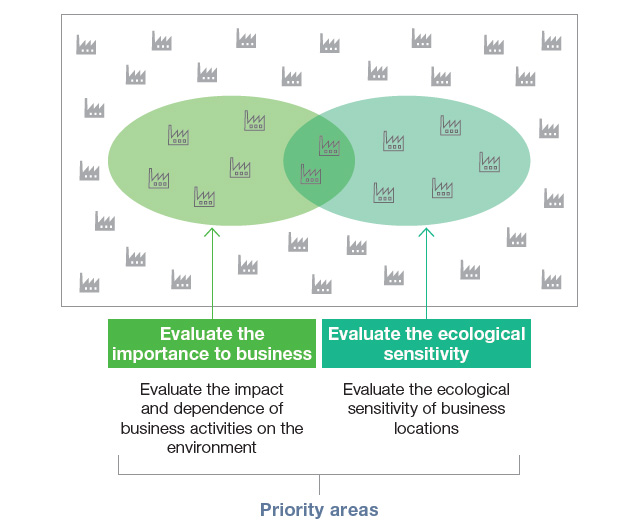

There are two methods for identifying priority sites: one method evaluates the magnitude of impact and dependence of business activities on the environment, and the other evaluates the ecological sensitivity of business sites. Through these two methods, the upstream of the azbil Group has identified 27 business partner locations.

Note: Prepared with reference to the LEAP approach, the guidance on the identification and assessment of nature-related issues

*4 Selecting key business partner sites while considering regional and industry biases

Direct operation (azbil Group business activities)

This initiative targets 17 major production sites, including the Shonan Factory, which is designated as a mother factory and identified as a facility with a high impact on natural capital.

Dependence and impact

The chart on the right lists dependencies and impacts relevant to the azbil Group at each stage of upstream, direct operation, and downstream, based on the nature and magnitude of business activity dependencies and impacts (ENCORE*5), ecological sensitivity, and business characteristics. Upstream, emissions may have a significant impact on the atmosphere, water quality, and soil. Direct operation and downstream processes*6 may have an environmental impact through waste disposal. Regarding dependence, no major concerns were identified; however, we recognize that some direct operation sites face water risks.

*5 ENCORE Partners (Global Canopy, UNEP FI, and UNEP-WCMC) (2024). ENCORE: Exploring Natural Capital Opportunities, Risks and Exposure. On-line, June 2024, Cambridge, UK: the ENCORE Partners. Available at: https://encorenature.org. DOI: https://doi.org/10.34892/dz3x-y059

*6 Regarding downstream impacts, the Locate analysis in the LEAP approach has not been conducted. Instead, impacts are estimated in the Evaluate analysis based on the waste disposal methods of the processing service providers.

| Scope | Dependence | Impact |

|---|---|---|

| Upstream | ー | Business partner activities could have an impact on atmosphere, water, and soil pollution. |

| Direct operation | Among Group companies responsible for manufacturing azbil Group products, Azbil Production (Thailand) Co., Ltd., and Azbil Control Instruments (Dalian) Co., Ltd., are located in waterstressed regions. | Operations at certain facilities located in areas with high ecosystem integrity might significantly impact ecosystems through atmosphere, water, and soil pollution. |

| Downstream | ー | Inappropriate waste treatment of products may result in pollution of the atmosphere, water, or soil. |

Policy

We support the spirit of the “Keidanren Declaration for Biodiversity and Guideline (revised December 12, 2023)” and will continue to participate in the “Keidanren Initiative for Biodiversity Conservation,” while also globally expanding sustainability management toward the realization of a sustainable society.

To bring about a society that is in harmony with nature, we will maintain a nature-positive approach and are continuing to support biodiversity preservation through our business, to promote initiatives in our supply chain involving our business partners, and to work in collaboration with various partners to further protect the natural environment.

Specific countermeasures for the analyzed opportunities and risks are currently under consideration and will be disclosed in the future.

Risk management

Under our risk management systems, we comprehensively manage risks that could have a significant impact on management as well as manage the impact itself, including those connected to climate change and natural capital.

Metrics and targets

Metrics and targets 【TCFD/TNFD】

We set indicators and targets related to climate change and natural capital and roll out environmental conservation activities. Items not disclosed as of the azbil Report 2025 publication will be considered for disclosure in the future.

Indicators and targets related to climate change

| Indicators for the azbil Group’s initiatives | Targets (FY2030) | |

|---|---|---|

| Effective reduction of CO2 at customers’ sites | Effect of automation | 3.40 million metric tons of CO2/year |

| Effect of energy management | ||

| Effect of maintenance and services | ||

| GHG emissions | Scope 1 + 2 | 55% reduction (from base year 2017) |

| Scope 3 | 33% reduction (from base year 2017) |

|

Indicators related to natural capital

| TNFD indicator number |

Factors for natural change | Indicators for the azbil Group’s initiatives | |

|---|---|---|---|

| C2.1 | Pollution / pollution removal | Use of water resources | Wastewater |

| C2.2 | Waste volume | Total waste volume | |

| Amount recycled | |||

| landfill volume | |||

| Recycling rate | |||

| Disposal rate | landfill volume/total waste volume | ||

| C2.4 | Emissions of PRTR-designated substances | Emissions to the atmosphere | |

| C3.0 | Resource use / replenishment | Use of water resources | Water withdrawal |

| Water consumption | |||

| Total water withdrawal from water stressed areas with water risks (water stressed areas) | Total water withdrawal (Azbil Production (Thailand) Co., Ltd.) | ||

| Total water withdrawal (Azbil Control Instruments (Dalian) Co., Ltd.) | |||

Notes:

1. Targets related to natural capital will be developed and disclosed in the future.

2. Please refer to the latest azbil ESG Databook for the actual results for each indicator.

Future initiatives

Based on the implementation items of this disclosure, going forward, we will advance our environmentally integrated management by conducting scenario analysis that integrates the fields of climate change and natural capital, thereby contributing to the global environment, including the well-being of society.

To this end, we plan to expand the scope of LEAP analysis to broaden and deepen it, and to quantify risks and opportunities.